2025 Summer Update: UK Tax

Part of a series of Quarterly UK Tax Updates. Stay up to date with the latest UK tax developments from April to June 2025, including changes to legislation, HMRC guidance, and key consultations.

£100 +VAT

2025 Summer Update: UK Tax

£100 +VAT

2025 Summer Update: UK Tax

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Advise on the new non-domicile tax regime

- Outline the approach being taken with the implementation of MTD for ITSA

- Recognise employer tax changes, from student loan repayments to NICs

- Explore amendments made to Capital Gains Tax and the available reliefs

- Understand case decisions on statutory residence, IR35 rules, VAT and CGT issues

About the course

Each quarter, we bring you the latest comprehensive updates on UK tax. This course covers key tax news from April, May, and June, including HMRC publications, consultations, case decisions, and legislation changes.

This summer update explores the removal of the current basis period for trading income, key changes to Making Tax Digital for Income Tax Self Assessment, and updates to tax treatment for company cars and vans.

You’ll gain clarity on the evolving tax landscape and be equipped to advise clients or your organisation on the latest legislative changes, case law, and guidance.

Contents

April

Monthly round up

HMRC publications

Self assessment reporting threshold

Scottish Rate Resolution

Other developments

Legislation and consultations

Focus: Non-dom tax regime reforms

Key dates for April

May

Monthly round up

HMRC publications

Focus: Spring Statement 2025

Making Tax Digital

Legislation and consultations

Key dates for May

June

Monthly round up

HMRC publications

Developments and consultations

Focus: Employer tax changes

Payrolling benefits in kind

Key dates for June

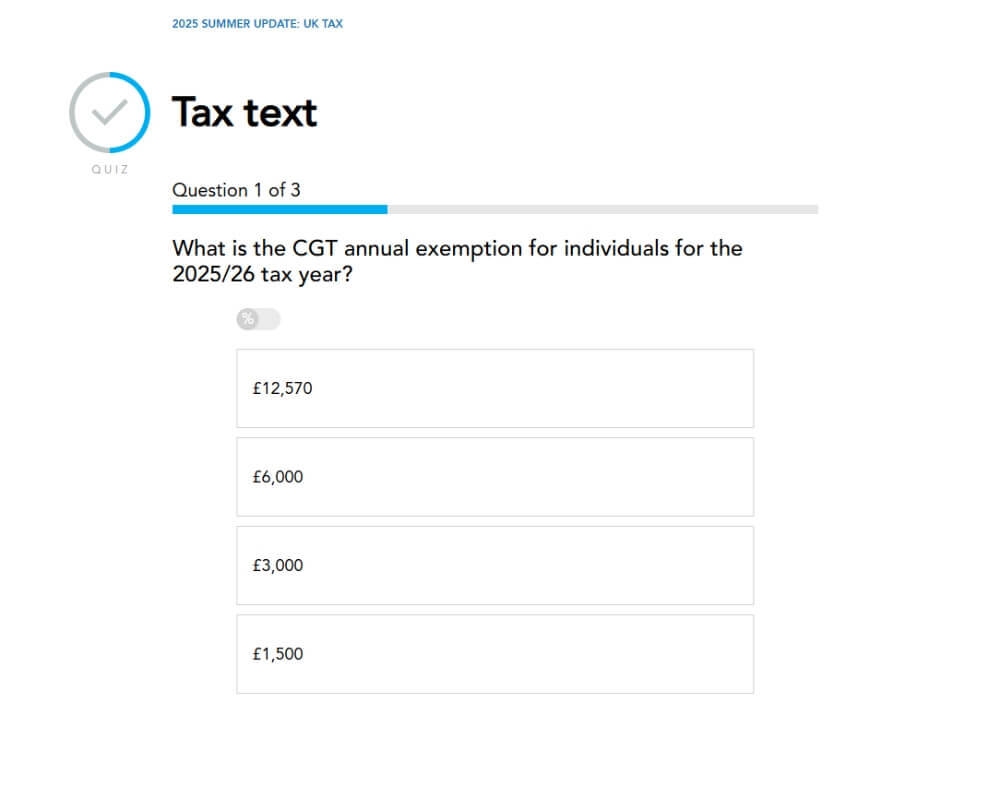

CGT review

Capital gains tax overview

Calculating capital gains

Deductible costs

The current CGT rates

Losses and main residences

Utilising CGT losses

Main residence relief

Business Assets Disposal Relief

Investors’ Relief

How it works

Author

accountingcpd

This course has been written by the accountingcpd author team.

You might also like

Take a look at some of our bestselling courses