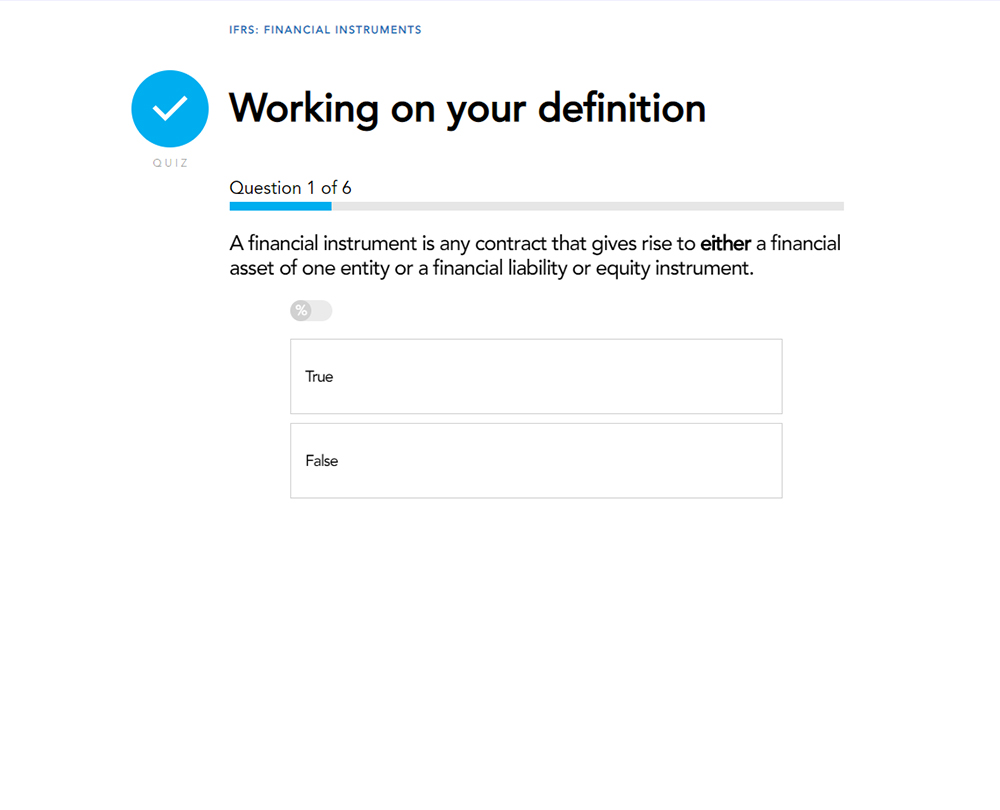

IFRS: Financial Instruments

This course helps you through the complexity by looking at all the IFRSs at play. It includes IFRS 7 which has just become fully operational and recent updates to IFRS 9.

£100 +VAT

IFRS: Financial Instruments

£100 +VAT

IFRS: Financial Instruments

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Consider the three separate IFRS areas regarding accounting for financial instruments

- Recognise and measure financial instruments

- Understand how to deal with financial instruments that are transferred in full or part, or items that are derecognised

- Understand the major features of disclosure in IFRS 7

About the course

The treatment of financial instruments can sometimes be very complex and it is necessary to have a clear understanding of the rules involved within the IFRSs to apply them properly. Getting this wrong could have a big impact on the financial statements.

There are three separate IFRS areas to consider regarding the accounting for financial instruments. IAS 32 deals with the presentation of financial instruments, IFRS 7 with their disclosure, and IFRS 9 with their recognition and measurement. These Standards need to be seen as something of a package.

Contents

Financial instruments: An overview

Three Standards

The impact of IFRS 9

Presentation and disclosure

Presentation

Overview of IAS 32

Objectives and scope of IAS 32

Some key definitions

Initial recognition

Puttable instruments and settlement provisions

Interest, dividends, losses and gains

Offsetting financial assets and liabilities

Three impacts

IFRS 9: How we got here

Overview of IFRS 9

A potted history

Timings

Recognition and derecognition

Accounting treatments

Classification and measurement

Two tests

IFRS 9 and impairment

Impairment

Hedge accounting

Hedge accounting

Objectives and scope

Which items qualify as hedges?

Accounting for hedging relationships

Hedging groups of items

Disclosures

Overview of IFRS 7

Objectives and scope of IFRS 7

Statement of financial position

Statement of comprehensive income

Hedge accounting disclosures

Risk disclosures

Transfers

Financial instruments disclosures

How it works

Author

Wayne Bartlett

Wayne is an internationally acclaimed speaker and trainer on all aspects of public and private sector accounting and auditing standards. He has been instrumental in helping to develop the profession internationally and has taken lead roles in the development of new professional bodies and the accounting profession in Mozambique and Rwanda, and been extensively involved in developing financial reporting in many countries across the globe.

You might also like

Take a look at some of our bestselling courses