Making Tax Digital

Revised and up to date for 2025/26. This course helps you understand the Making Tax Digital project and the latest timelines for businesses and individuals, along with the key practicalities involved.

£100 +VAT

Making Tax Digital

£100 +VAT

This course will enable you to

- Familiarise yourself with the latest MTD timelines in place for businesses and individuals making the transformation

- Implement the necessary software and training requirements for MTD

- Consider the practicalities, costs and benefits of MTD

- Discover the various transitional stages for the MTD project and key future changes we can expect to see.

About the course

Making Tax Digital (MTD) continues to reshape how businesses and individuals engage with the UK tax system. While the direction of travel is widely supported, the scale and pace of change continue to raise questions. Since April 2022, nearly all VAT-registered businesses have been required to maintain digital records and submit returns using compatible software. Further changes, including MTD for Income Tax Self Assessment (ITSA), are being phased in.

This course helps you stay up to date with the latest MTD developments, including revised timelines and upcoming requirements. You’ll explore the practical steps needed to comply – such as software choices, digital links, and staff training – alongside a review of the costs, benefits, and transition stages for different types of taxpayers.

Whether you’re preparing clients or your own organisation, this course will equip you with the insight to implement MTD effectively and adapt to the evolving digital tax landscape.

Please Note: This course only covers the United Kingdom

Contents

The timeline for Making Tax Digital

Getting started with Making Tax Digital

Coming into effect

The key dates

Understanding digital reporting for businesses

Software requirements for MTD

Incorporating MTD for VAT

Software for MTD

Specific software requirements

What the legislation says

Understanding digital links

Choosing the right software

Software providers

Understanding the practicalities

Costs and benefits

Practical challenges

Opportunities of MTD

Facing internal issues

Training and support for MTD

The future of MTD

Beginning the transition

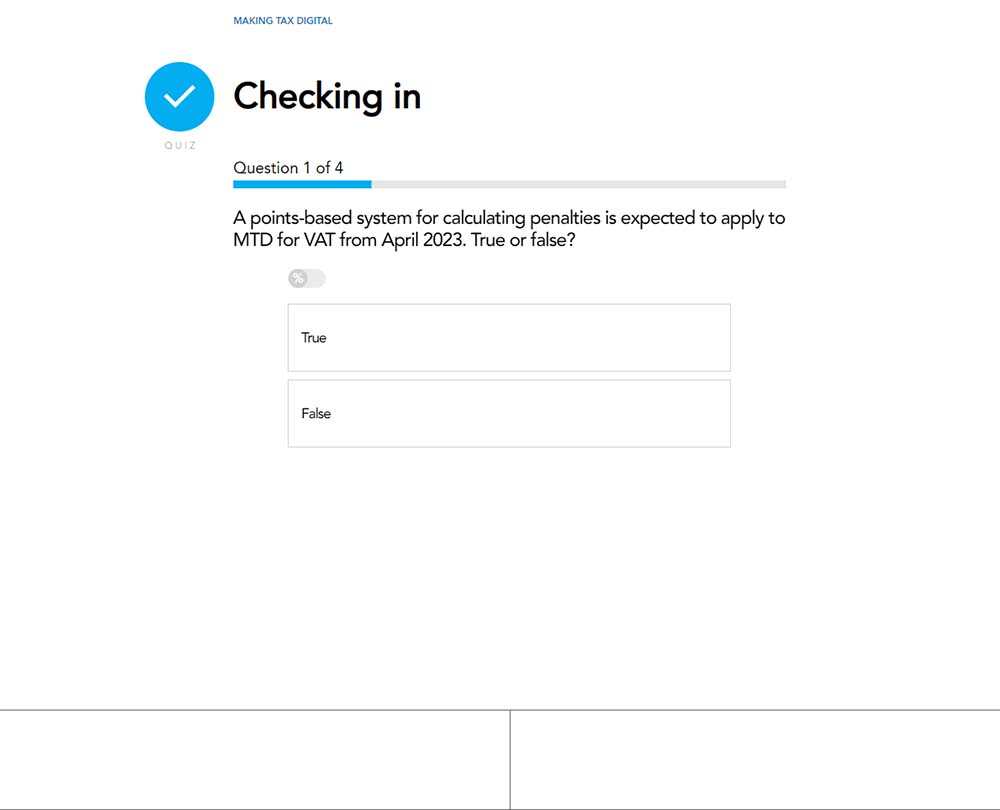

Penalties for late submission

What the future holds

The impact of MTD on income tax

MTD for corporation tax

How it works

Author

Sarah Laing

Sarah is a Chartered Tax Accountant (CTA) and a member of the Chartered Institute of Taxation (CIOT). Sarah currently works as a freelance tax author providing technical writing services to the tax and accountancy professions.

You might also like

Take a look at some of our bestselling courses