Owner Managed Businesses

Revised and up to date for 2025/26. With the number of owner managed businesses on the rise, clients will expect you to be familiar with the complex rules. This course guides you through the tax, incorporation, and income issues that arise at each stage of a business’s life.

£100 +VAT

Owner Managed Businesses

£100 +VAT

Owner Managed Businesses

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Get to grips with the basics of owner managed businesses (OMBs)

- Handle issues related to business growth such as capital expenditure and VAT registration

- Advise on when and how incorporation becomes a sensible option

- Ensure your clients generate profit in a tax efficient way

- Offer support on whether to sell a business or pass it on to the “next generation”

About the course

There has been a significant increase in the number of owner managed businesses (OMBs) in recent years. Whether sole traders, limited companies or partnerships, these businesses face complex rules around setup, growth, and eventual exit. As accountants, it’s our role to guide clients through these challenges — from tax efficiency and incorporation decisions to succession planning.

This course provides a comprehensive overview of OMBs, covering tax considerations, incorporation, income structuring, and business exit strategies. You’ll explore the key issues that arise at different stages of the business life cycle, including capital expenditure, VAT registration, profit extraction, and disposal options.

By completing this course, you’ll be equipped to support your clients more confidently and strategically — helping them structure their business for growth, reduce tax liabilities, and make informed decisions about selling or passing on their business.

Please Note: This course only covers regulation in the United Kingdom

Contents

Overview

Explaining tax for owner managed businesses

What is an OMB?

Creating an OMB

Trade vs business

The early years

The early days of a business

HMRC registration

Tax years

Working out the profits

Business expenditure

Reporting

Growth

Key steps for company growth

Capital expenditure

Annual investment allowance

Working out AIA

The VAT system

VAT sales and invoices

VAT returns and penalties

Incorporation

In good company

The advantages of trading as a limited company

Corporation tax

To incorporate or not?

The incorporation process

Option 2: Holdover relief route

Option 3: Sale to the company

Profit extraction

Who profits?

Extracting profit from your business

Salary v dividends

Salary first

Other methods are available!

Directors’ loan accounts

Selling the business

An offer too good to resist

Key issues when selling a business

Selling the company business

The base cost

Personally owned assets

What if the proceeds aren’t wholly upfront cash?

Potential tax savings

Passing the business on

The business as a legacy

Passing on to a new generation

IHT and lifetime transfers

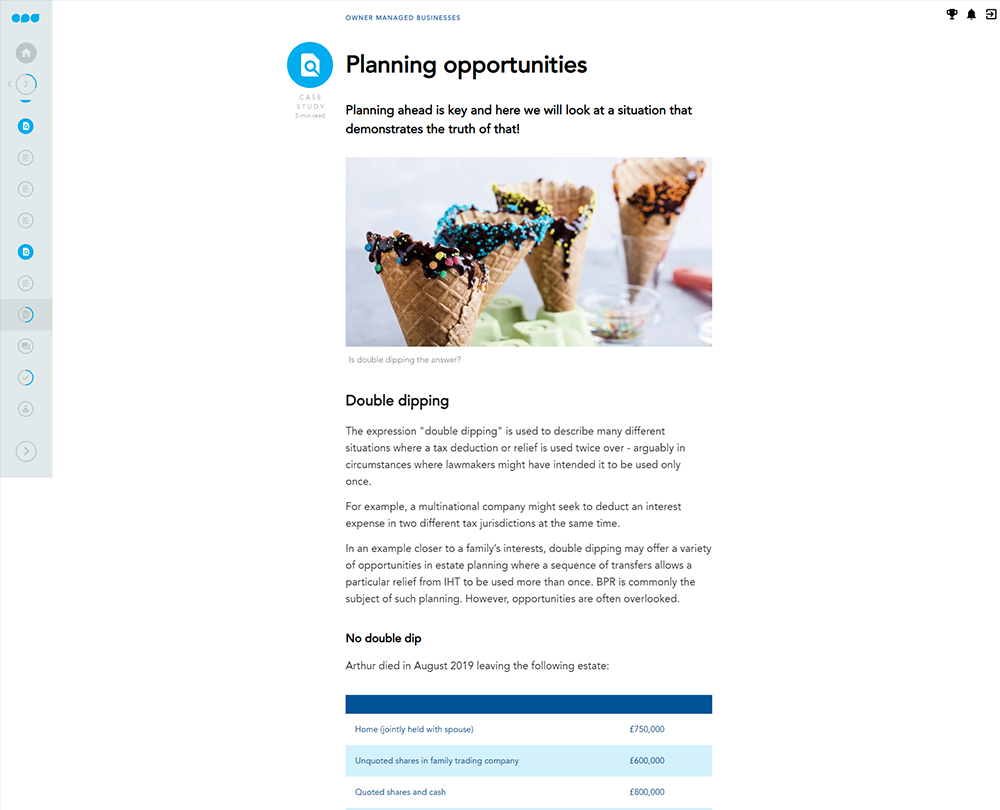

Business property relief

Qualifying for BPR

Problems with loans

How it works

Author

Andy Rainford

Andrew Rainford BA (Hons), ATT, CTA trained and qualified with an independent London firm of accountants, and subsequently worked on EY’s personal tax consultancy team.

Now based in North Wales, he runs his own tax consultancy and writing business, Red Dragon Consulting, working directly for private clients and also supporting other tax advisers.

You might also like

Take a look at some of our bestselling courses