Practice Update: Ethical Issues for Accountants

Revised and up to date for 2025. Accountants in practice frequently face morally complex situations that leave you questioning the correct action to take. This course explores common ethical grey areas, when to apply professional judgement to your decisions and how your practice can maintain an ethical culture.

£100 +VAT

Practice Update: Ethical Issues for Accountants

£100 +VAT

Practice Update: Ethical Issues for Accountants

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Develop a thorough understanding of the key elements of the ethical codes required by professional bodies.

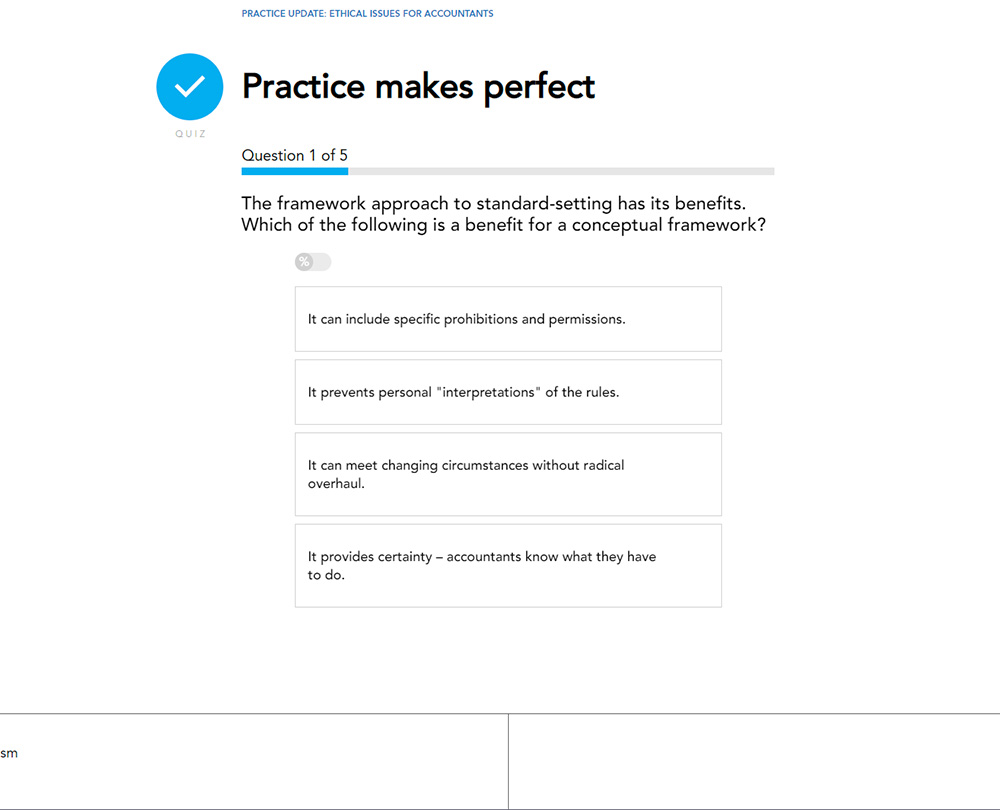

- Apply the ethical frameworks to help you make good decisions in difficult situations.

- Balance your duty to your client with your duty to society when providing tax advice.

- Build an ethical culture within your practice.

About the course

It’s vital that every accountant in practice should be familiar with the principles set down in the various ethical codes of the accountancy bodies. The reputation of a firm may be impacted by our capacity to stay objective, moral, and honest in our work. However, when ethical grey areas do arise, finding the right course of action from these codes isn’t always simple.

This course considers such ethical grey areas and provides accountants in practice with the practical, day-to-day approaches they need to avoid making unsafe decisions. You will employ codes of professional conduct to fulfil your role, including when providing advice on taxation matters. You’ll gain an understanding of the role of ethics in the workplace and how to establish an ethical culture in your practice.

Please Note: This course covers some UK only regulations

Contents

Ethics in practice

Accountants in society

How frameworks work

The framework approach

Sticking to principles

Ethical codes and accountancy bodies

Recognising ethical threats

Types of ethical threat

The deep end of dependence

Professional scepticism

Principles and dilemmas

Ethical challenges

The theory of ethics

Dealing with dilemmas

Proximity

Culture clash

Normalisation of deviance

Being normalised

Socialising unethical behaviour

Tax and ethics

Professional conduct in relation to taxation

The role of the tax advisor

Does tax avoidance exist?

The law

The PCRT ethical principles

The relevant standards

Helpsheets

Professional judgement

Simplicity vs complexity

NOCLAR provisions

Creating an ethical culture

The tone at the top

The basis of an ethical culture

The hidden aspects of corporate culture

Normalisation

Poor communication

Building an ethical compliance culture

Developing an ethical culture

Compliance risk management

Policies and procedures

Ethics and HR

Maintaining an ethical culture

Performance appraisals

How it works

Author

John Taylor

John is a Chartered Accountant who has spent many years advising small and medium-sized businesses across the North of England. John is the author of two industry standard textbooks: Millichamp – Auditing and Forensic Accounting. He has also written several auditing textbooks for AAT courses.

You might also like

Take a look at some of our bestselling courses