R&D Tax Relief

This course has been updated for 2025/26. Explore how R&D relief works for both the pre-1 April 2024 regime and the new merged scheme that applies to accounting periods starting on or after that date. Learn to assess whether R&D is taking place, determine qualifying costs, and calculate and prepare successful claims for R&D relief on behalf of your clients.

£100 +VAT

R&D Tax Relief

£100 +VAT

This course will enable you to

- Understand how each scheme works, what the benefits are, who is eligible and how much can be claimed

- Identify when qualifying R&D is taking place

- Compile an R&D cost breakdown, avoiding common pitfalls

- Calculate SME R&D tax relief and tax credit claim amounts

- Calculate R&D relief under the new merged scheme and the enhanced R&D-intensive support

- Know what to do when there is a change to a claim rate

- Make and prepare a successful claim under each scheme

About the course

The UK’s R&D tax relief schemes provide an incentive and support, in the form of corporation tax savings and tax credit payments, to companies carrying out innovative projects in science and technology.

Do you know how to judge whether your company or client is eligible for R&D tax relief, and if so how to go about making a successful claim? If you can get to grips with the schemes, you could significantly reduce your business or client’s tax liability or even generate a cash payment.

The R&D tax relief scheme is changing, for accounting periods starting on or before 1 April 2024, so here we look at the details of the new merged scheme, as well as the SME R&D relief, which is still valid for claims relating to accounting periods starting on or before 1 April 2024.

Please Note: This course only cover UK tax law

Contents

Overview of R&D tax reliefs

R&D tax reliefs

The benefits

Stats on the schemes

The right scheme for you

Eligibility

Current claim rates

Qualifying projects and activities

Defining R&D

Science and technology

Advance

Uncertainty

R&D examples

Important people to involve

Competent professional

Qualifying activities

Identifying qualifying projects and activities

Qualifying costs

Claimable costs

Staff and other key costs

Contracted work

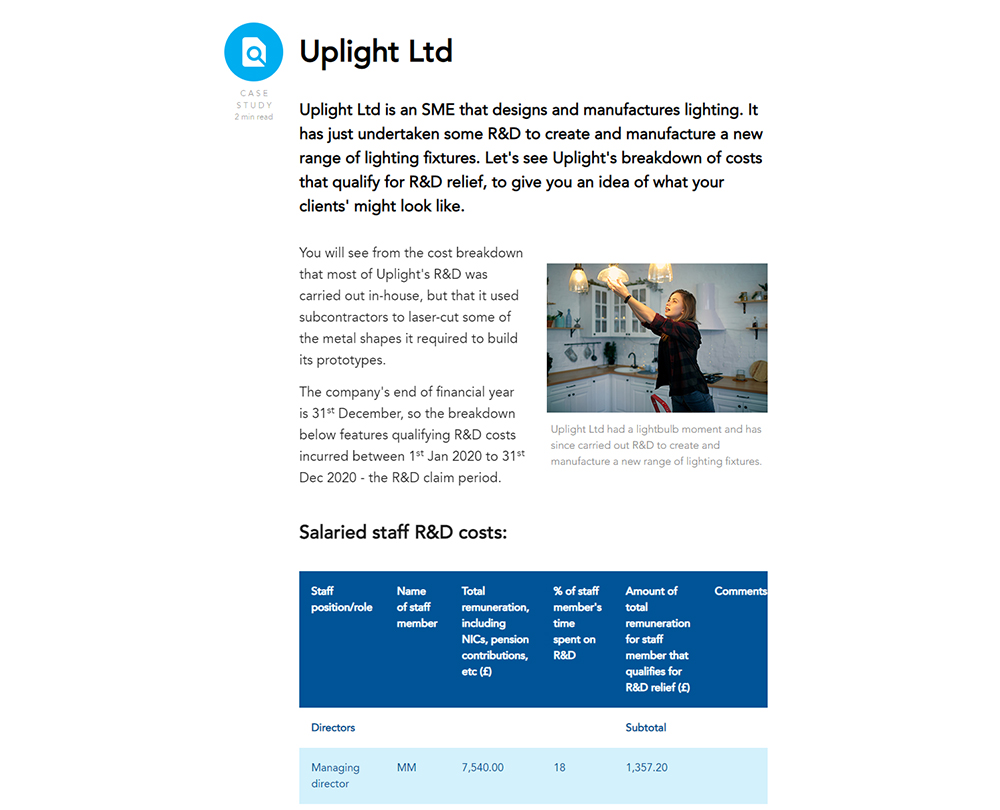

Cost breakdown

What can go wrong?

Common pitfalls

SME R&D tax relief and tax credits

Making a calculation

Calculation steps

Applying the right rates

Enhancement and tax credit rate changes

Merged scheme and R&D-intensive support

Overview

Relief under the merged scheme

PAYE cap

R&D-intensive SMEs

Preparing claims

Key SME qualification checks

Making and preparing a claim

What to include in a claim

Technical justification

Cost breakdown summary

Successful claims

Responses from HMRC

HMRC compliance checks

How it works

Author

Linda Eziquiel & Andy Rainford

Linda Eziquiel is a R&D tax credit specialist experienced in helping UK SMEs. Andy Rainford runs his own tax consultancy and writing business, Red Dragon Consulting.

You might also like

Take a look at some of our bestselling courses