Self-Assessment for Companies

Revised and up to date for 2025/26. All UK companies must submit a corporation tax self-assessment return to HMRC. This course provides essential guidance to help you stay compliant and file with confidence.

£100 +VAT

Self-Assessment for Companies

£100 +VAT

Self-Assessment for Companies

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Gain a detailed overview of self-assessment for companies

- Familiarise yourself with the legislation and rules that govern companies and their tax affairs

- Understand corporation tax – past and present rates and how to determine whether a company needs to pay it

- Evaluate key features of the CTSA system – registering with HMRC, payment deadlines, record-keeping requirements and accounting rules

- Understand the practicalities of submitting a corporation tax return, including filing deadlines, penalties, and how and when HMRC might open an enquiry

- Explore the procedures for dealing with HMRC and how to appeal decisions relating to self-assessment returns

About the course

All UK limited companies are required to submit a corporation tax self-assessment (CTSA) return to HMRC and pay the appropriate tax. For accountants, understanding how to complete and manage corporation tax returns is essential. This course equips you with the practical knowledge to support your clients through the CTSA process and remain compliant with HMRC requirements.

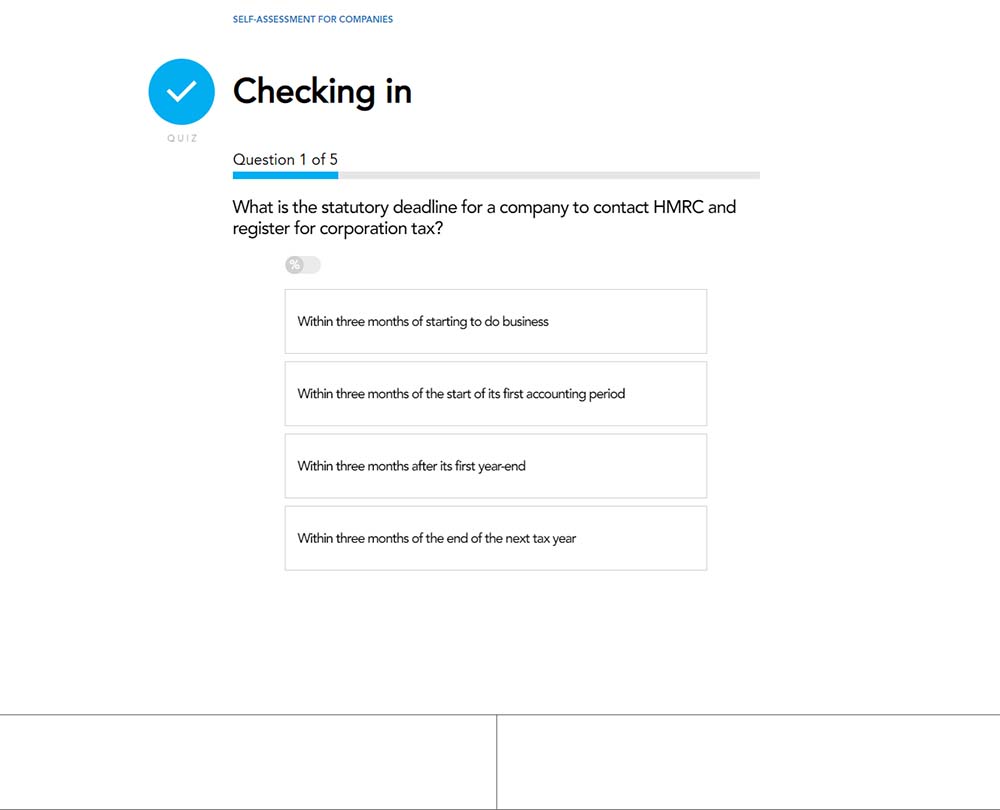

Corporation tax applies to most UK companies, and failing to meet HMRC’s rules can result in significant penalties. This course explores who needs to pay corporation tax, current and historical tax rates, and how to identify liability. You’ll gain insight into how the CTSA system works — including how to register a company with HMRC, meet payment and filing deadlines, and maintain appropriate records.

You’ll also develop a detailed understanding of how to complete and submit a CTSA return, respond to HMRC enquiries, and navigate appeals processes. This course brings together key legislative knowledge and practical processes to help you advise confidently and stay on top of your corporation tax responsibilities.

Please Note: This course only covers UK tax law

Contents

An overview of self-assessment

Self-assessment for companies

Limited companies and the Companies Act 2006

Director duties

Company accounts

Preparing the accounts

Personal service companies

Understanding corporation tax

Corporation tax liabilities

The CTSA system

Registering a company with HMRC

Corporation tax self-assessment

The key features of CTSA

Paying corporation tax

Determining the accounting period

Record-keeping requirements

Company tax returns

Preparing a company tax return

Completing a company tax return

Deadlines for filing company tax returns

How to file a company tax return

The penalty system

Queries and enquiries

HMRC and appeals

Contacting HMRC

Appealing a decision

Reviewing tax decisions

Dealing with enquiries

Taxpayers and tribunals

An alternative dispute resolution

HMRC’s litigation and settlement strategys

How it works

Author

Sarah Laing

Sarah is a Chartered Tax Accountant (CTA) and a member of the Chartered Institute of Taxation (CIOT). Sarah currently works as a freelance tax author providing technical writing services to the tax and accountancy professions.

You might also like

Take a look at some of our bestselling courses