Tax in Buying and Selling an SME Business

Revised and up to date for 2025/26.This course looks at the major taxation implications of buying and selling a business. The course will give you a better understanding of the options available to achieve the desired commercial outcome whilst minimising the tax payable.

£100 +VAT

Tax in Buying and Selling an SME Business

£100 +VAT

Tax in Buying and Selling an SME Business

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Ensure the success of your purchase by considering the tax implications when buying a business

- Recognise the tax involved in selling a business, and understand entrepreneur’s relief, rollover relief and incorporation relief

- Understand the purpose and nature of deferred consideration

- Identify the specific taxation rules that apply when the businesses being bought and sold are companies or carried on by companies

- Consider the challenges and tax incentives of selling company shares to employees

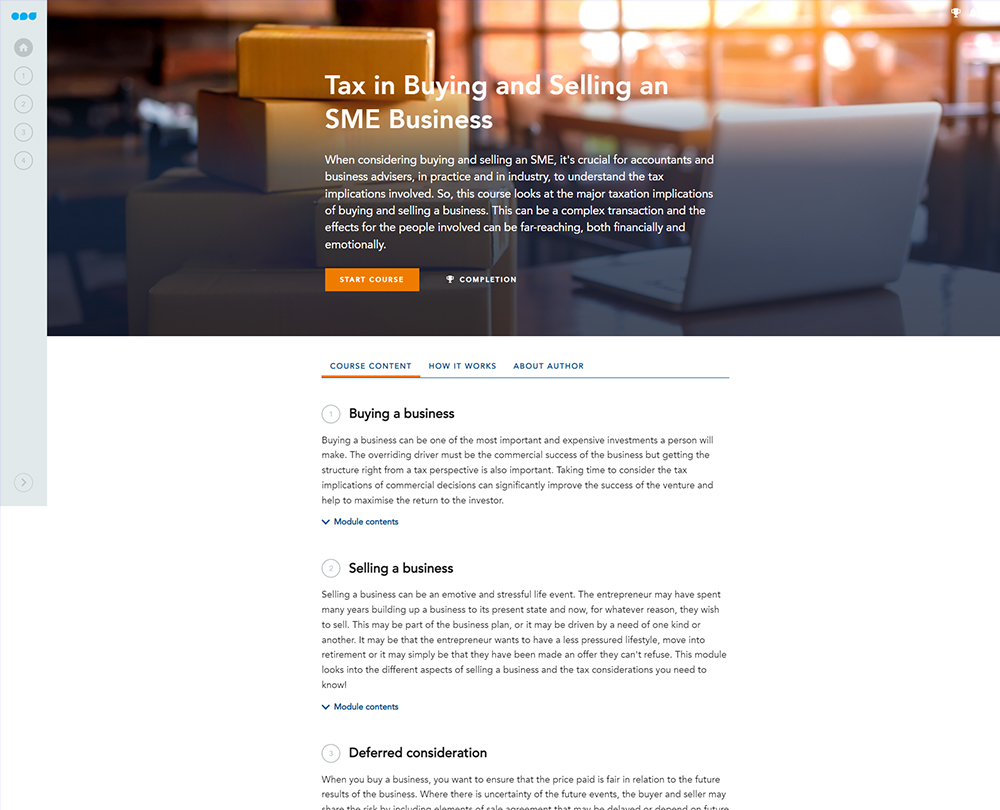

About the course

Buying and selling a business is a complex transaction and the tax implications for the people involved can be significant. Structuring the transaction to achieve the best taxation position is a balancing act – it requires weighing the commercial and taxation considerations and negotiating between the buyer and seller, who may be seeking different structures depending on their personal circumstances.

This course looks at the major taxation implications of buying and selling a business. The course will give you a better understanding of the options available to achieve the desired commercial outcome whilst minimising the tax payable.

Please Note: This course only covers UK tax

Contents

Buying a business

The tax implications of buying and selling a business

What type of business are you buying?

Carrying on a business following purchase

Key issues when buying a business

The tax considerations from a loan financed business purchase

The advantages of trading as a company

How could the exit route influence an acquisition?

How to determine capital allowance claims

VAT implications when buying a business

Selling a business

What is a company sale?

Explaining asset sales

Tax implications when selling a business

How to determine capital allowance claims

Understanding Business Asset Disposal Relief

What is rollover relief?

Incorporation relief

Deferred consideration

What is deferred consideration?

How deferred consideration affects a sale

Understanding share-based consideration

Earn outs and selling a business

Considerations for structuring deferred consideration

Corporate issues

Reorganising corporations

Structuring a business prior to a sale

What is a hive down?

Buying company shares

Tax warranties and indemnities

The challenges of selling to employees

The tax incentives for selling to employees

How it works

Author

Andrew Law

Andrew Law has been in professional tax practice for over 30 years advising SME business on taxation matters and has advised on the sale and purchase of numerous businesses of all kinds and sizes.

You might also like

Take a look at some of our bestselling courses