Valuation

This course introduces valuation processes and provides an overview of the main methods involved. You’ll explore the use of asset-based, earnings and cash flow-based valuations as well as the complexities involved with non-standard and internet-based businesses.

£100 +VAT

Valuation

£100 +VAT

This course will enable you to

- Understand the key concepts underlying the process of valuation

- Know when to use asset-based valuations and the difficulties involved for declining businesses

- Gain a better understanding of earnings-based and cash flow-based valuations

- Identify the issues involved in valuing a non-standard business

- Recognise the differences to consider when valuing an internet-based business

About the course

How do you value a business? In short, there’s no right answer. Value can differ depending on a company’s circumstances and there are numerous valuation methods and formulae that can be used when buying and selling a company.

This course provides everything you need for valuing businesses confidently. It introduces you to valuation processes and provides an overview of the main valuation methods. This includes exploring the asset-based, earnings and cash flow-based valuations. You’ll also be able to recognise the key differences to consider when valuing non-standard and internet businesses.

Contents

Value and valuation

What is value?

Types of value

Measuring value

What is valuation?

Making mistakes

Most valuations are wrong

Bases of valuation

Dividend yield-based valuations

Capital asset pricing model

Asset-based valuations

Asset-based valuations

Benefits and drawbacks

Basis of valuation

Assets

On the rocks

Declining businesses

Valuing a declining business

Earnings and cash flow-based valuations

sEarnings-based valuations

Learn to earn

Price/earnings ratio

Profit multiples

The real world

Discounted cash flow modelling

Non-standard businesses

Setting standards

Minority interest in an unlisted company

Valuing a new company

Intrinsic value

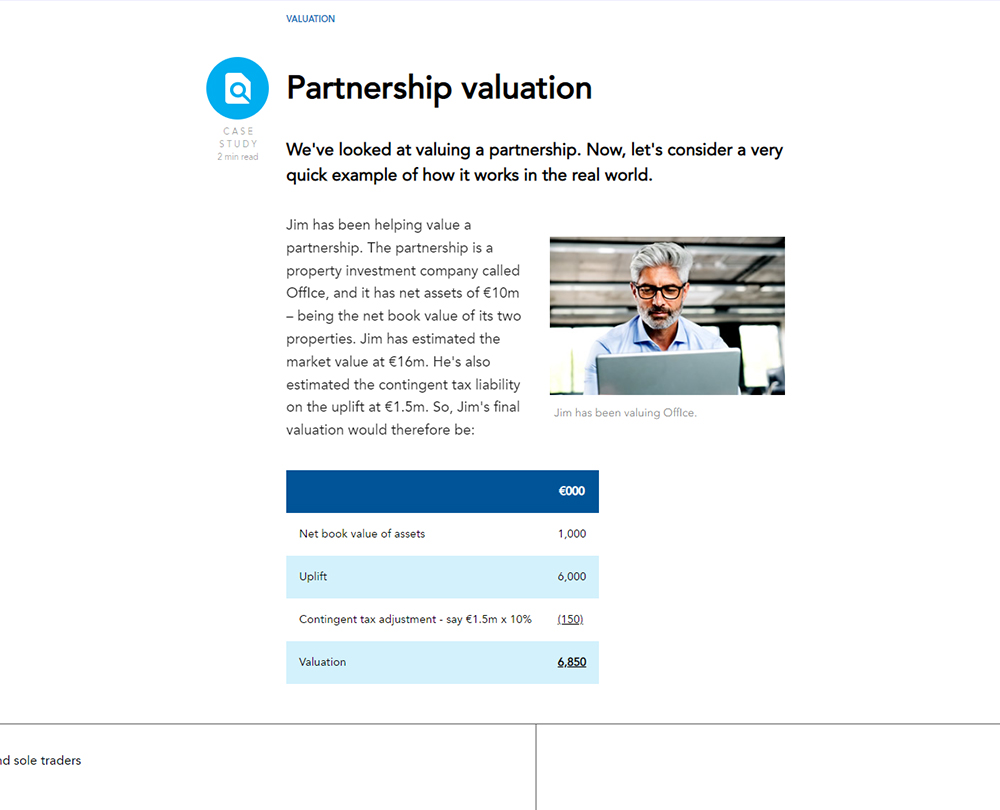

Valuing partnerships and sole traders

Hunting for goodwill

Valuing goodwill

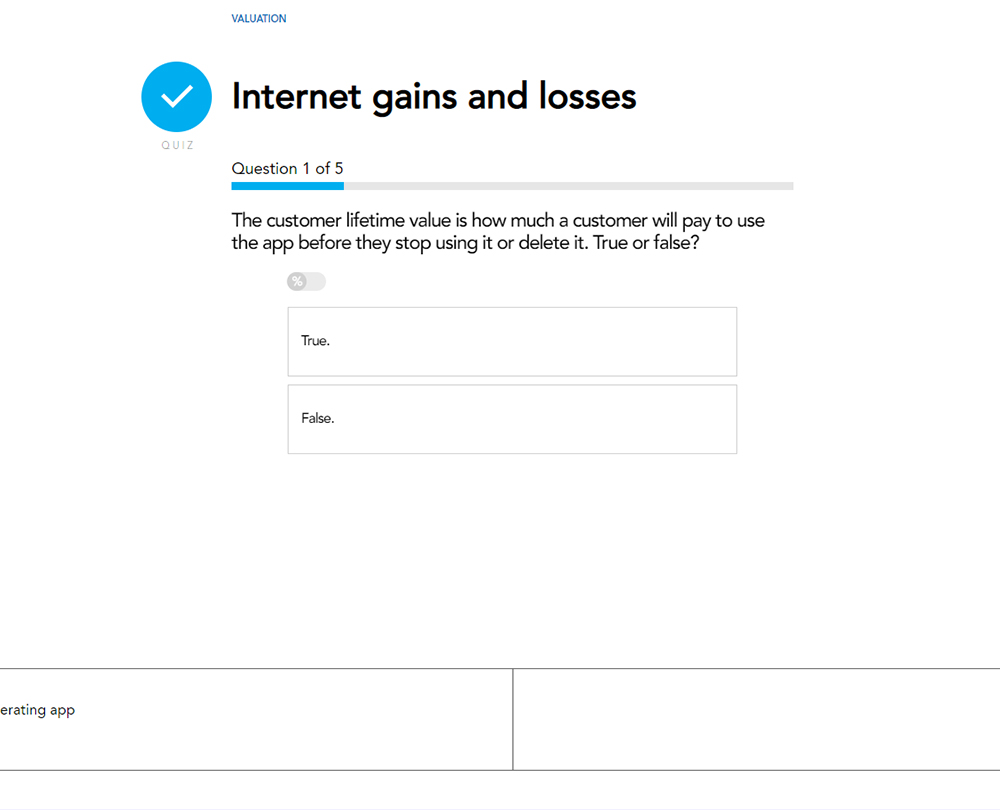

Internet-based businesses

Internet issues

Valuing an internet-based business

Will it last?

Methods of valuation

Other methods

Investigations

Valuing an app

Valuing a subscription or income generating app

How it works

Author

John Taylor

John is a Chartered Accountant who has spent many years advising small and medium-sized businesses across the North of England. John is the author of two industry standard textbooks: Millichamp – Auditing and Forensic Accounting. He has also written several auditing textbooks for AAT courses.

You might also like

Take a look at some of our bestselling courses