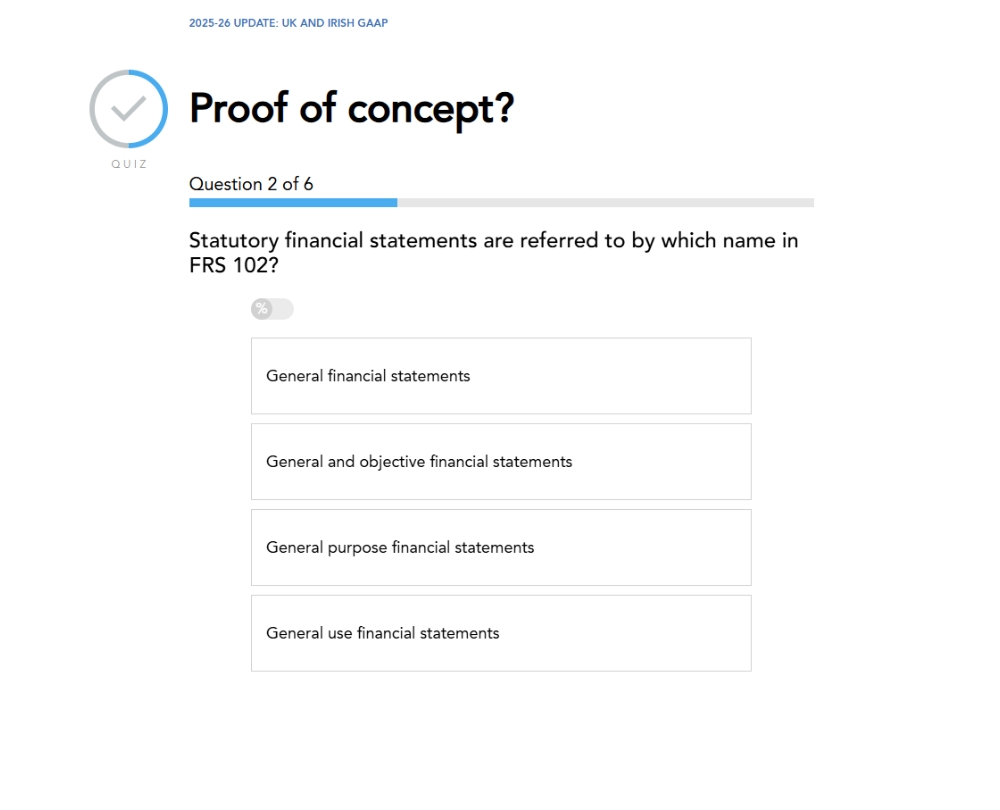

2025-26 Update: UK and Irish GAAP

UK and Irish accounting standards have seen a significant amount of change following the FRC’s periodic review. This update dives into the detail of key amendments in the areas of concepts and pervasive principles, revenue recognition, and accounting for small entities.

£100 +VAT

2025-26 Update: UK and Irish GAAP

£100 +VAT

2025-26 Update: UK and Irish GAAP

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Outline the major changes to reporting requirements for UK and Irish entities

- Explore the redrafted sections on revenue from contracts with customers

- Apply the new five-step model approach to revenue recognition

- Understand new disclosure requirements for small entities

- Discuss the realignment of the concepts and pervasive principles

About the course

The Financial Reporting Council (FRC) has completed its latest periodic review of accounting standards, resulting in new editions published in September 2024. All areas of FRS 102, except Section 30 Foreign Currency Translation, have undergone changes, from editorial amendments to substantive updates.

This course covers the most notable changes, including lease accounting, revenue recognition, and small company disclosure requirements. It focuses on the redrafted sections for revenue from contracts with customers, applying the new five-step model, and the updated presentation and disclosure requirements for small entities following increased company size thresholds in the UK and EU. Additionally, it examines the revised concepts and pervasive principles now aligned with the IASB’s Conceptual Framework for Financial Reporting.

By the end of this course, you will be well-equipped to navigate the updated standards and ensure compliance in your financial reporting.

Contents

Periodic Review

Periodic reviews

The periodic review

Headline changes

Key milestones of the periodic review 2024

Lease accounting

Expected impact on the financial statements

Revenue recognition

Practical considerations

Section 1A Small Entities

Revenue recognition

Impact of the periodic review

Disclosures on revenue recognition

Common issues

Agent and principal relationships

Deferred payment

Exchanges of goods or services

Small entities

Key issues

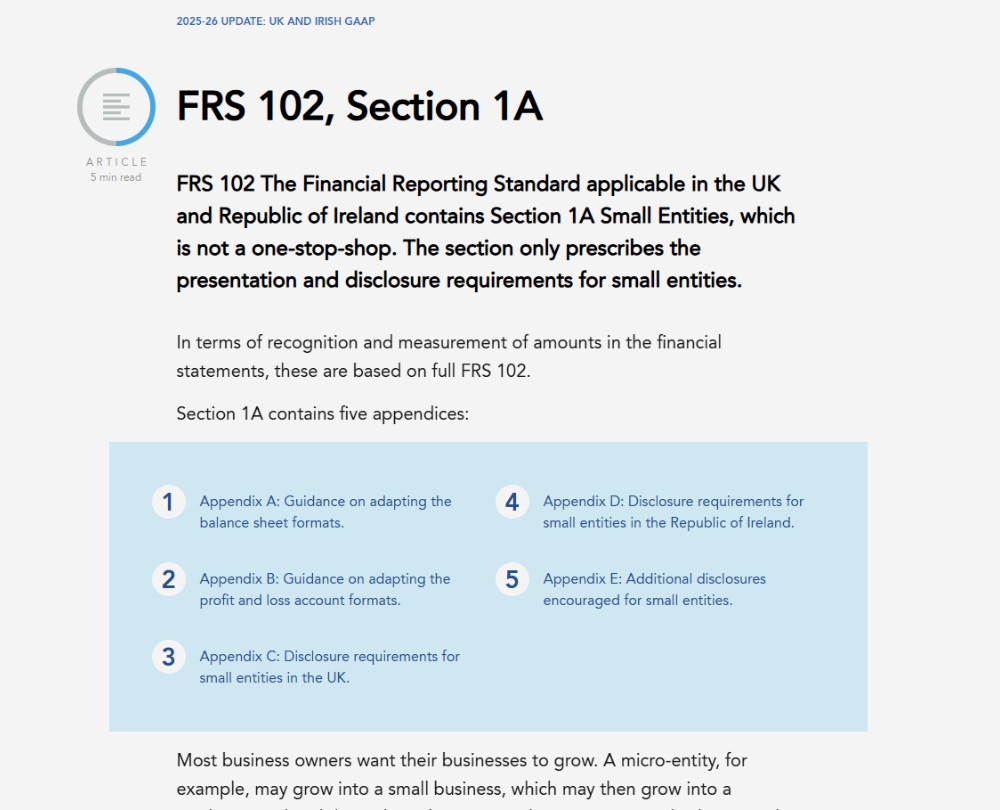

FRS 102, Section 1A

Periodic review

Impact of the periodic review

True and fair view

Guidance and standards

Concepts and pervasive principles

Overview of concepts and pervasive principles

Section 2 Concepts and Pervasive Principles

Periodic review changes

Exploring Section 2

Scope and objectives

Qualitative characteristics of useful financial information

Financial statements and the reporting entity etc

Recognition, measurement, presentation and disclosure

Section 2A Fair Value Measurement

How it works

Author

Steve Collings

Steve is Director at Leavitt Walmsley Associates, a firm of Certified Chartered Accountants. He is an internationally recognised speaker, writer and commentator on all matters to do with financial reporting and auditing. Steve is a prolific author, having written over 25 books and currently represents the North West of England on ACCA”s Practice Network Panel.

You might also like

Take a look at some of our bestselling courses