Technology, AI and AML Compliance

Rapid technological change has made it easier for criminals to move illicit funds, while AML regulations have tightened in response. Now is the time to harness AI-driven tools to counter financial crime and digitally transform your compliance systems.

£100 +VAT

Technology, AI and AML Compliance

£100 +VAT

Technology, AI and AML Compliance

This course is not currently available. To find out more, please get in touch.

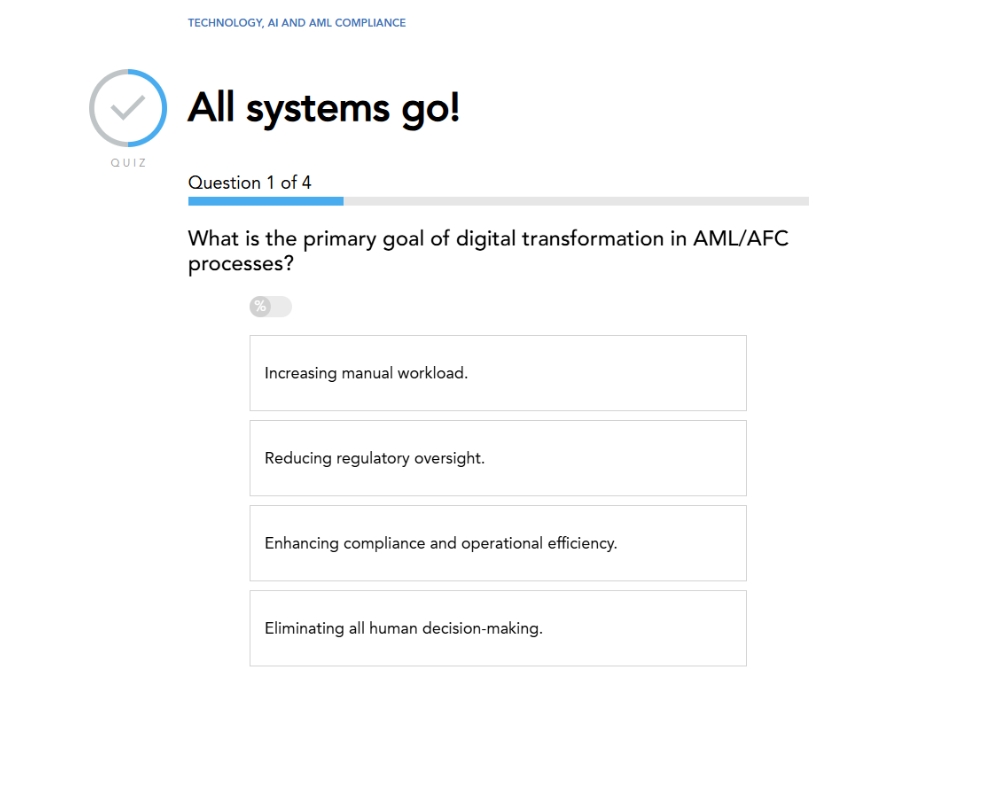

This course will enable you to

- Understand why AI needs to be implemented in AML compliance systems

- Discuss the capabilities of specific AI-driven tools

- Identify technology to improve and future-proof your AML/AFC processes

- Develop goalposts for your organisation’s digital transformation

About the course

Rapid technological change and the growth of global trade have created new channels for illicit funds to move faster and more discreetly than ever before. At the same time, compliance regulations are tightening, expectations are rising, and the penalties for breaking them can be high — making it essential that accountants stay ahead of the curve.

Artificial Intelligence is already transforming AML compliance, which is why now is the time to embrace these advances. Technologies like Natural Language Processing are enhancing how we interpret and respond to large volumes of unstructured data, while Open-Source Intelligence (OSINT) is empowering professionals to surface hidden risks and verify client information through publicly available data.

Learn how to embed AI-driven thinking into your compliance strategy, set practical goals for your organisation’s digital transformation, and unlock more resilient, future-ready AML/AFC processes.

Contents

The digital landscape

The evolution of financial crime

The current AML landscape

The forces driving change

Technological advancements

Getting the right IT support

Transforming AML compliance

Designing a future-proof anti-financial crime system

Understanding regulatory requirements

The right regulations

Assessing risks

Who are you in business with?

Third party risk

Tracking transactions

Reporting obligations

Forward thinking

Understanding the potential of AI

Are we ready for AI?

Machine learning

Natural language processing

The dark side of AI

APIs and OSINT

Digitally transform the way your work

Most beneficial technology

Be an AML technology advocate

First steps

Choosing the right technology

One to watch

Maximising performance

Streamlining your digital system

How it works

Author

Michael Harris

Michael works with technology and data companies who provide anti-money laundering and anti-bribery compliance solutions. Michael offers unique insights into the changing geo-political risk landscape, the evolution of financial crime regulation, the genesis and development of AML and ABC regulation, and how data and technology can empower organisations.

You might also like

Take a look at some of our bestselling courses