2025-26 Update: UK Tax

With a new Government, major announcements in the Autumn Budget and Spring Statement, and the Finance Act 2025, this year brings significant tax changes for accountants to keep up with.

£100 +VAT

2025-26 Update: UK Tax

£100 +VAT

2025-26 Update: UK Tax

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Apply the latest tax rates, thresholds and allowances

- Navigate the complex IR35 rules and recent case law

- Understand the new foreign income and gains regime for non-UK domiciles

- Evaluate key business tax updates, including National Insurance, mandatory payrolling, and Corporation Tax

- Explain the new residence-based regime for Inheritance Tax

- Explore VAT changes, including late payment penalties and the removal of private school exemptions

- Advise on changes to Stamp Duty Land Tax rates and thresholds

About the course

With a new Government in place, major announcements in the Autumn Budget and Spring Statement, and the Finance Act 2025 passing through a new Parliament, this year brings significant change for accountants to keep up with.

This course brings you up to speed with the most important developments in personal, business, capital, and indirect taxation. It focuses on what’s changed, what it means for your work, and how to adapt effectively.

Get fully briefed on the latest tax landscape and gain the knowledge and confidence to apply updated rates and thresholds, advise on legislative impacts, and support your clients or organisation through a period of significant transition.

Contents

Personal tax

Overview

Income tax rates and thresholds

IR35 update: Where are we now?

Non-UK domiciled individuals

Tax changes for non-UK domiciled individuals

FIG regime

Impacts of the FIG regime

Business tax

Overview

Corporation Tax rates

Corporation Tax Roadmap 2024

Trading and property allowances

NICs for the self-employed

Changes for employers

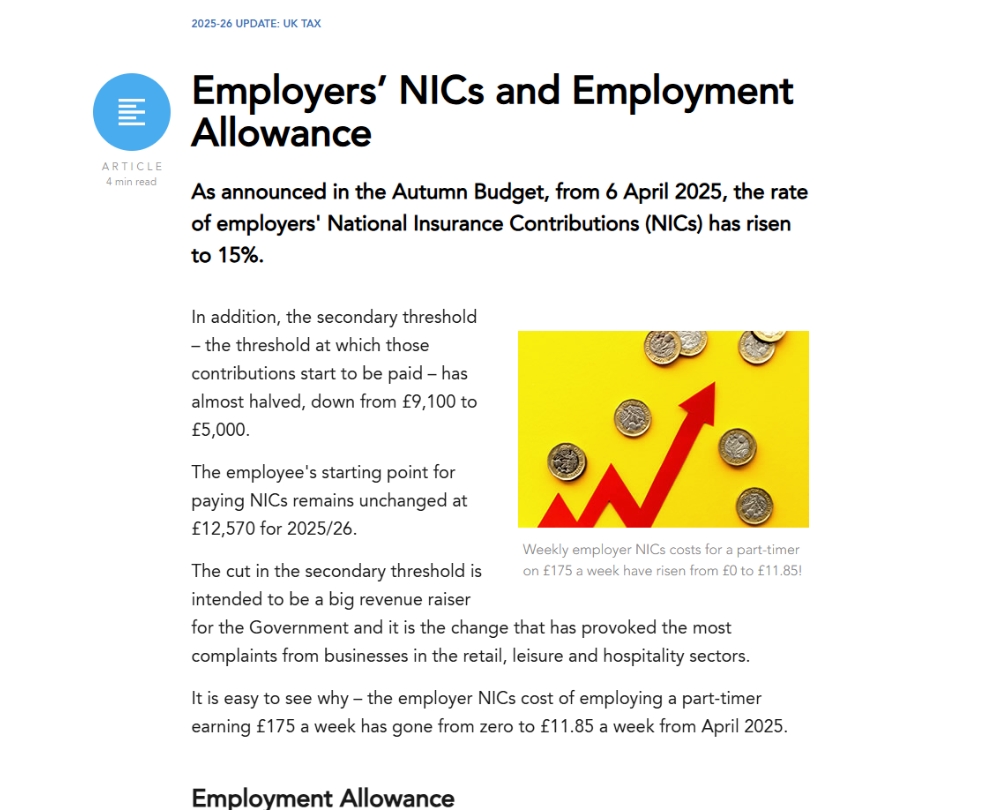

Employers’ NICs and Employment Allowance

National Minimum Wage

Mandatory payrolling

Furnished holiday lettings

Capital tax

Overview

Capital Gains Tax rates and allowances

Annual exemption

Business Assets Disposal Relief

Investors’ Relief

BPR and APR

The reliefs

The changes

IHT residence-based regime

How is residence determined?

Indirect tax

Closing the tax gap

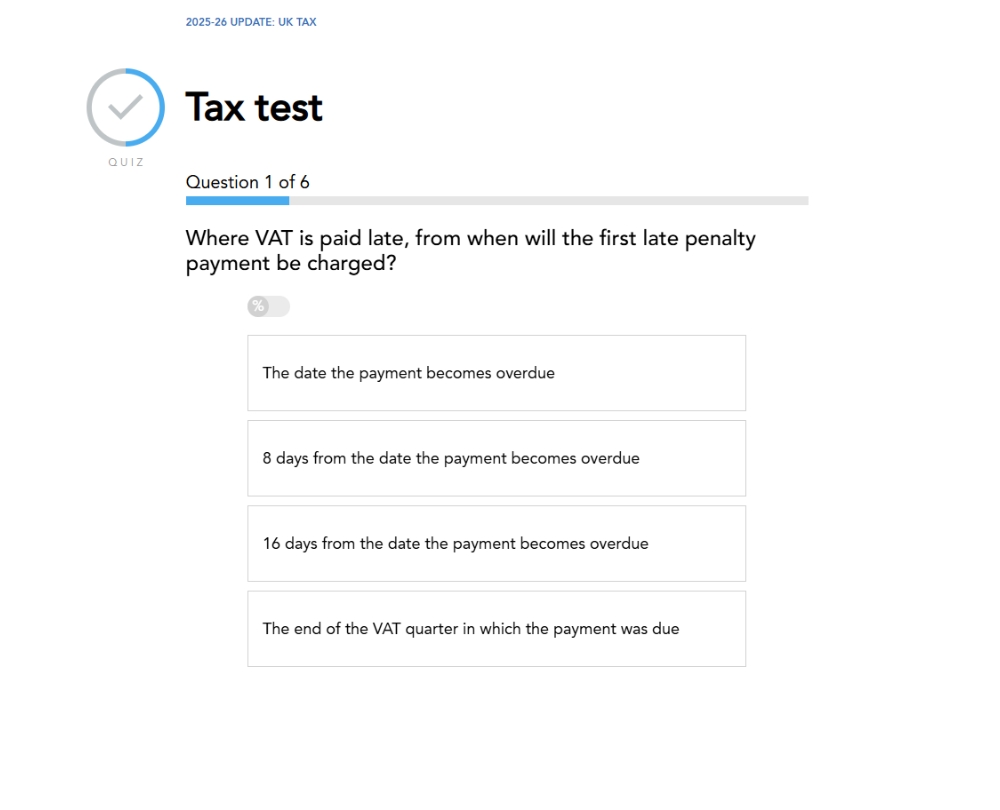

Late payment penalties for VAT

Time to pay arrangements

VAT: Private school fees

Administration for schools

Stamp Duty Land Tax

Changes to standard SDLT

Higher rates and first time buyer’s relief

Alcohol duty

Reliefs, reduced rates and administration

How it works

Author

Sarah Laing

Sarah is a Chartered Tax Accountant (CTA) and a member of the Chartered Institute of Taxation (CIOT). Sarah currently works as a freelance tax author providing technical writing services to the tax and accountancy professions.

You might also like

Take a look at some of our bestselling courses