2025 Autumn Update: UK Tax

Part of a series of Quarterly UK Tax Updates. Stay up to date with the latest UK tax developments from July to September 2025, including legislative updates, HMRC initiatives, and important case decisions.

£100 +VAT

2025 Autumn Update: UK Tax

£100 +VAT

2025 Autumn Update: UK Tax

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Explain the Government’s Tax-Free Childcare programme

- Outline the details, pros and cons of salary sacrifice schemes

- Discuss the Draft Finance Bill 2025-26 and HMRC’s Transformation Roadmap

- Recognise the progress made with Making Tax Digital

- Plan to use AI tools effectively in your tax work

About the course

Each quarter, we bring you the latest comprehensive updates on UK tax. This course covers key tax news from July, August, and September, including HMRC publications, consultations, case decisions, and legislation changes.

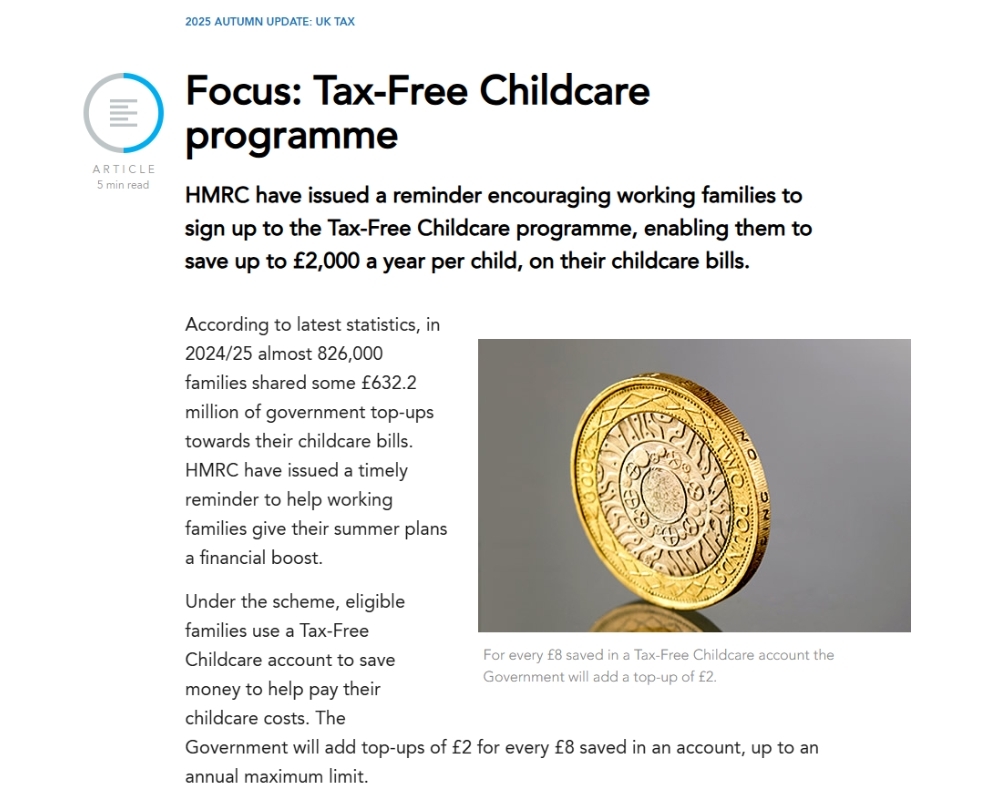

This autumn update focuses on tax-free childcare, changes to late payment penalties, salary sacrifice schemes as a tool for cost-efficient payroll planning, and key provisions in the Draft Finance Bill 2025–26. You’ll also explore HMRC’s Transformation Roadmap and recent case decisions across income tax, VAT, capital gains tax, and employment tax.

Stay current with HMRC’s digitisation initiatives and explore how AI tools can support tax work when used with the right checks and professional oversight. This update will equip you with the insights you need to advise clients or support your organisation with the latest developments in UK tax policy and practice.

Contents

July

Monthly round up

HMRC publications

Focus: Tax-Free Childcare programme

Legislation and other developments

Key dates for July

August

Monthly round up

HMRC publications

Legislation and other developments

Focus: Salary sacrifice

Key dates for August

September

Monthly round up

HMRC publications

Other developments

Draft Finance Bill 2025-26

Focus: Transformation Roadmap

Key dates for September

HMRC, digitisation and AI

Overview

HMRC campaigns – individuals

HMRC campaigns – companies

Making Tax Digital update

Making Tax Digital for Corporation Tax

AI in tax

How it works

Author

accountingcpd

This course has been written by the accountingcpd author team.

You might also like

Take a look at some of our bestselling courses