2025 Update: Irish Tax

How has Finance Act 2024 affected your clients or business? This course examines the Act through four perspectives — personal, business, capital, and indirect taxes – equipping you to advise clients or colleagues with confidence.

£100 +VAT

2025 Update: Irish Tax

£100 +VAT

2025 Update: Irish Tax

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Get to grips with the key tax updates for 2025

- Understand the impact of changes to taxes relating to housing and pensions

- Stay up to date with changes to SRCOP and tax credits

- Appreciate the implications on businesses of key legislative changes including to R&D tax credit, interest limitation rules, and new corporation tax relief

- Advise on changes to capital taxes including CAT agricultural relief, increase stamp duty and increases to CAT thresholds

- Stay on top of changes to VAT, excise duties, and customs duties

About the course

2024 was an election year, and a lot of promises were made. So, it’s no surprise that Finance Act 2024 contained some big changes to tax legislation, attempting to address the problems facing farmers, renters, and small landlords, amongst others.

This course looks at these changes through four different lenses — personal, business, capital, and indirect taxes – equipping you to advise clients or colleagues with confidence. We distil the complex and wide-ranging legislation into its key points, giving you a comprehensive understanding of Finance Act 2024 and its impact across different demographics and institutions.

Contents

Personal taxes

Changes in personal tax

Income tax rates and credits

Universal Social Charge

Housing

Residential Zoned Land Tax

What’s new in pensions

Pensions

Small benefit exemption

Split-year treatment

Energy

Business taxes

Changes in business tax

Participation exemption

Research and development corporation tax credit

Pillar Two

The impact of Pillar Two

Start-up company relief

Relief for listing expenses

Amendments to interest limitation rules

Leases

Charities

Capital taxes

Changes in capital tax

Capital Acquisitions Tax thresholds

Interest-free loans

The effect on farmers

CAT agricultural relief

Retirement relief

Angel investor CGT relief

Stamp duty

Farming tax measures

Indirect taxes and other measures

Changes in VAT

Increased VAT registration thresholds

VAT rate changes

Farmer’s flat rate compensation

Management of EU alternative investment funds

Deduction for input VAT

Payment service providers

VAT rate clarification

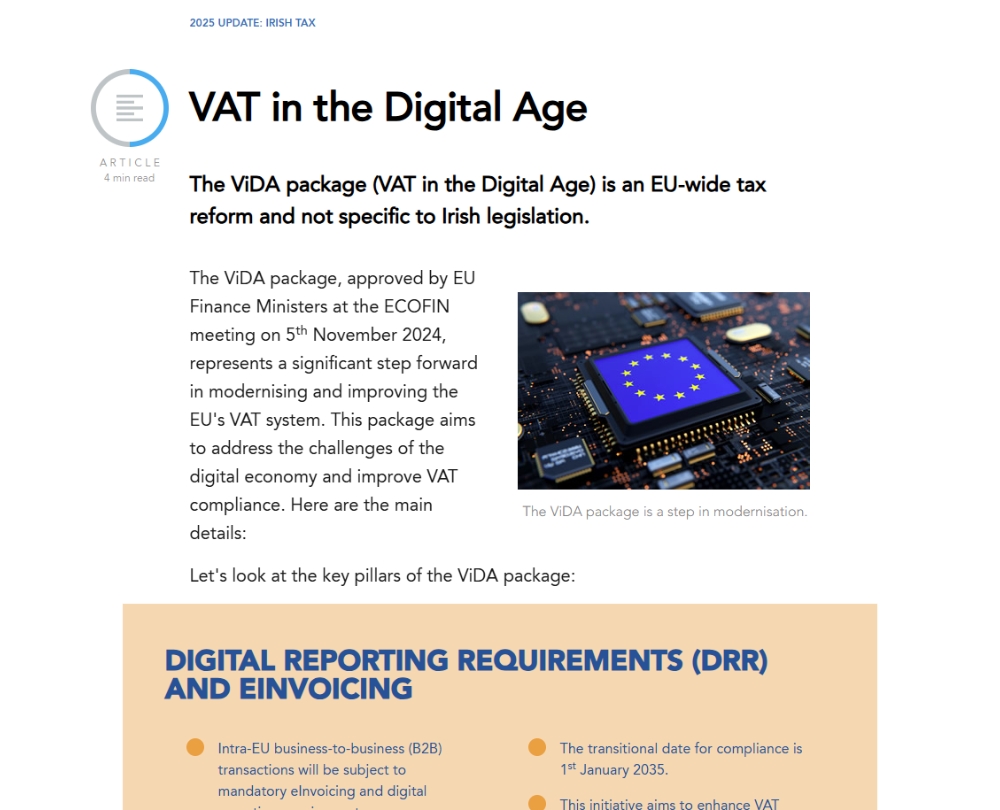

The ViDA package

VAT in the Digital Age

E-liquid Products Tax

Tobacco products

Cider and perry

Betting duty changes

How it works

Author

Mairéad Hennessy

Mairéad specialises in succession planning for SMEs and their owners, retirement planning, corporate structuring, inheritance tax, property transactions and VAT, through the tax practice she founded in 2016. Mairead represents CCAB-I on TALC (indirect taxes), which is the main forum for making representations between the Irish Revenue and practitioners on tax administration in Ireland.

You might also like

Take a look at some of our bestselling courses