2025 Winter Update: UK Tax

Part of a series of Quarterly UK Tax Updates. Stay up to date with the latest developments from October to December 2025, including the Autumn Budget and key developments on pensions, Child Benefit, and VAT.

£100 +VAT

2025 Winter Update: UK Tax

£100 +VAT

2025 Winter Update: UK Tax

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Examine the main tax measures announced in the 2025 Autumn Budget

- Understand tax planning issues around pension withdrawals

- Explore the new High Income Child Benefit Charge payment service

- Review the VAT Flat Rate Scheme

- Discuss recent case decisions on income and employment tax, and exempt supplies for VAT

About the course

Each quarter, we bring you the latest comprehensive updates on UK tax. This course covers key tax news from October, November and December, including HMRC publications, consultations, case decisions, and changes to tax legislation.

This winter update focuses on the 2025 Autumn Budget and its many tax-related measures, including personal tax changes, business and employment tax updates, and developments in VAT and indirect taxes. You’ll also explore pension withdrawal planning, the new payment service for the High Income Child Benefit Charge, and updates to the VAT Flat Rate Scheme.

Gain insight into lead VAT cases involving healthcare services and the scope of the medical care exemption, and stay informed on the policy and compliance developments shaping UK tax as we move into 2026. This course will help you advise clients or support your organisation with clarity and confidence.

Contents

October

Monthly round up

HMRC publications

Legislation and other developments

Focus: Pension withdrawals

Key dates for October

November

Monthly roundup

HMRC publications

Other tax developments

Focus: New HICBC payment service launched

Key dates for November

December

Monthly roundup

HMRC publications

Focus: VAT Flat Rate Scheme

Key dates for December

Autumn Budget

Budget headlines

Key announcements

Personal taxes

New charges

Investments

Business taxes

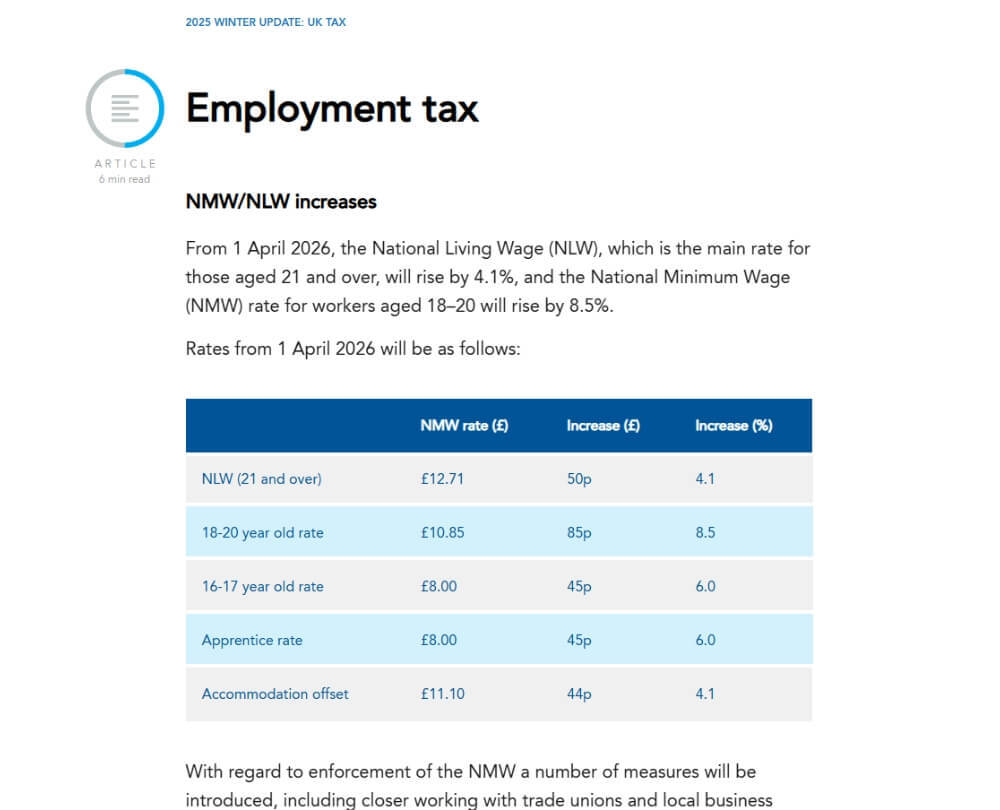

Employment tax

Inheritance tax

Value Added Tax

Indirect taxes

Tax administration

How it works

Author

accountingcpd

This course has been written by the accountingcpd author team.

You might also like

Take a look at some of our bestselling courses