Capital Allowances

Revised and up to date for 2025/26. This course will help you to manage tax liability by claiming the appropriate capital allowances. Discover the types of reliefs available for cars and structures and buildings. You’ll also gain an awareness of the associated issues and pitfalls involved.

£100 +VAT

Capital Allowances

£100 +VAT

This course will enable you to

- Understand the basics of capital allowances

- Define what is and isn’t capital expenditure

- Recognise who can claim capital allowances and how they are claimed

- Identify different capital ‘pools’ and the rules for each

- Advise on capital allowances for cars, structures and buildings

- Avoid some common pitfalls

About the course

Capital allowances reduce a business’s taxable profits and enable it to retain more of its profits. With depreciation not allowable for tax purposes, a thorough understanding of capital allowances is critical in managing the tax liability for any business with capital expenditure.

This course explains how to identify capital expenditure and whether it is allowable, and explains capital allowances and the practical issues you could encounter. You’ll discover different capital allowances ‘pools’ and rules for each, as well as the reliefs available for cars and structures and buildings.

Please note, this course only covers the United Kingdom.

Contents

Introduction to capital allowances

Capital allowances overview

Capital allowances

Claiming capital allowances

Finding the tax legislation

Explaining capital expenditure

Plant and machinery

Full expensing

Other types of capital allowances

Key things to remember

Pooling and fast-track allowances

Capital allowance pools

Claiming capital allowances

Explaining pooling

Understanding first year allowances

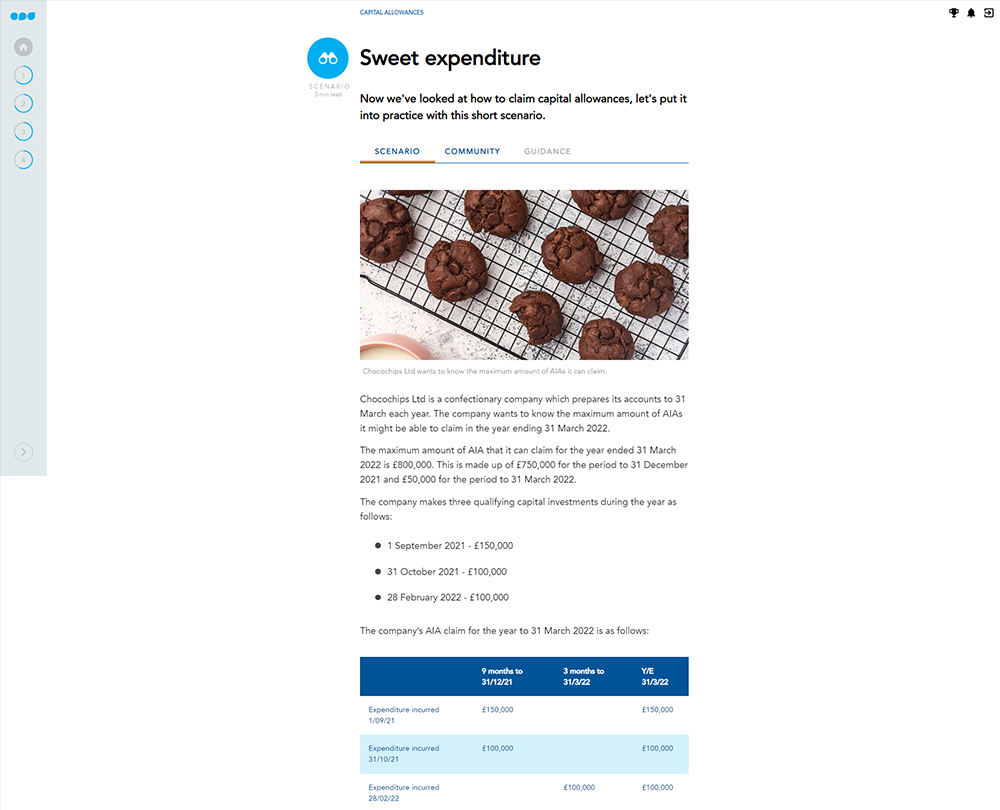

The AIA

General exclusions

Further allowances

Available reliefs for cars

Buildings

Dealing with structures and buildings

The key features of SBAs

Qualifying activities

Claiming SBAs

Other types of expenditure

Research and development allowances

Practical issues

Key practical issues

Claiming capital allowances

The date of expenditure

Time limits for capital allowances

AIAs and WDAs

Getting the timing right

Writing off small pools

How it works

Author

Sarah Laing

Sarah is a Chartered Tax Accountant (CTA) and a member of the Chartered Institute of Taxation (CIOT). Sarah currently works as a freelance tax author providing technical writing services to the tax and accountancy professions.

You might also like

Take a look at some of our bestselling courses