Corporation Tax Loss Relief

Revised and up to date for 2025/26. Loss planning is crucial for your business and clients. Get to grips with types of losses, the process and complexities involved in receiving loss relief, and the significant reforms to the treatment of carried-forward losses and corporate capital losses.

£100 +VAT

Corporation Tax Loss Relief

£100 +VAT

Corporation Tax Loss Relief

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Understand common types of losses and why effective loss planning is crucial for your clients

- Get up to date with the changes introduced by corporate income loss restriction (CILR) and corporate capital loss restriction (CCLR)

- Consider the pre-CILR loss relief provisions

- Get to grips with the complexities involved with CILR and CCLR

About the course

Corporation tax loss relief is a complex area. Not only do you have to contend with numerous types of losses such as trading and capital, but you also need to be familiar with the different rules and restrictions regarding these reliefs.

This course offers a detailed guide to the corporation tax loss regime and looks at why loss planning is crucial for your businesses and clients. Get to grips with types of losses, the process and complexities involved in receiving the relief, and the significant reforms to the treatment of carried-forward losses and corporate capital losses.

Please Note: This course only covers the United Kingdom tax system

Contents

Understanding corporation tax losses

Loss relief

Trading losses

Non-trading loan relationship deficits

Property losses

Management expenses

Winning and losing

Capital losses

The importance of record keeping

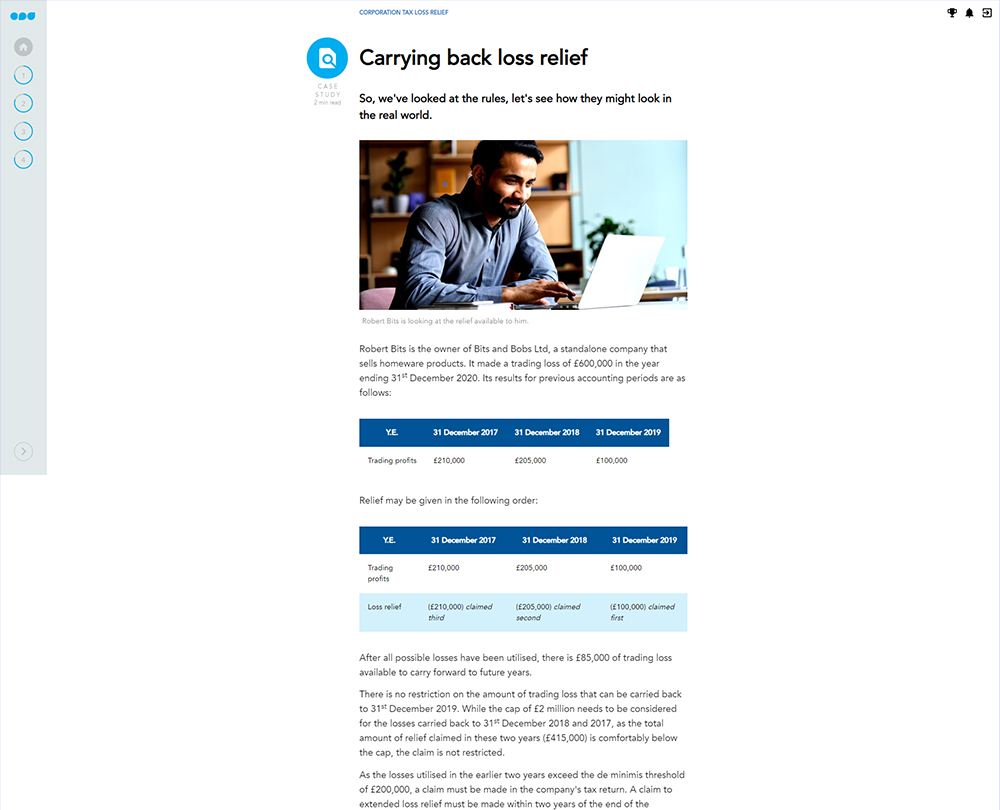

Receiving relief

Corporate income loss restriction

Utilising loss

Corporate capital loss restriction

Change in company ownership

TAAR

Old rules

Trading losses

Learning the rules

Pre-2017 non-trading loan relationship deficits

Property losses

Expenses of management

Capital losses

Priority of losses

New rules

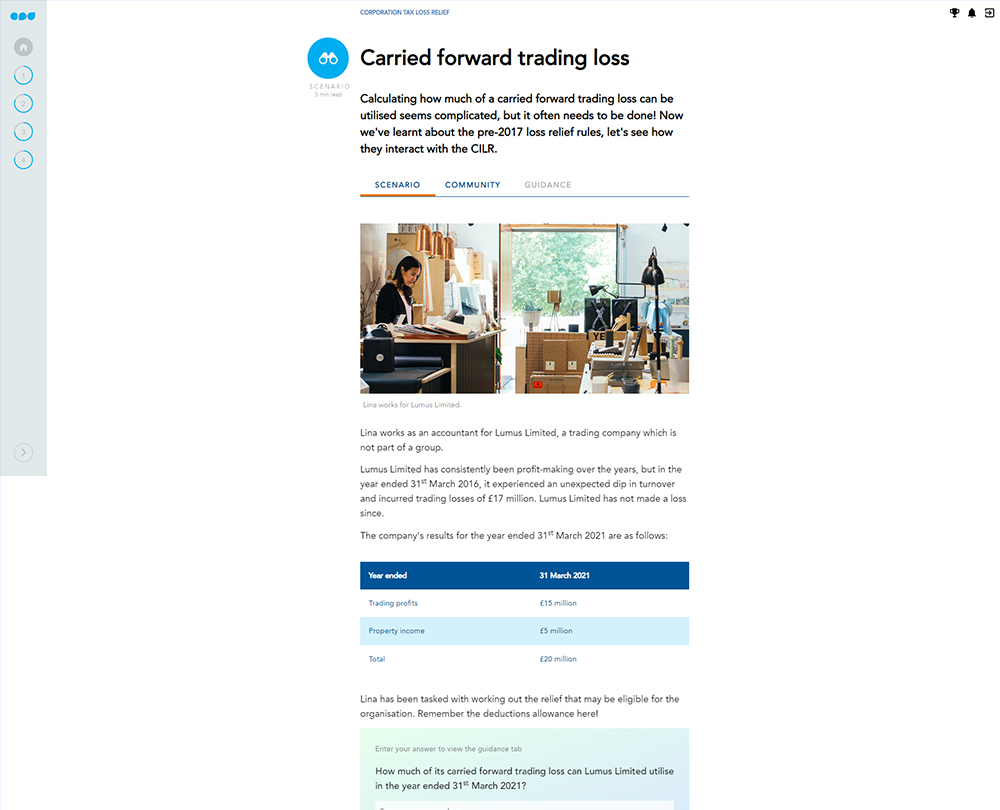

Post-April 2017 trading losses

Terminal loss relief

Going forward

Post-April 2017 non-trading loan relationship deficits

Other losses

The deductions allowance

How it works

Author

Lucy Webb

Lucy is a chartered accountant (ACA) and chartered tax adviser (CTA). She gained her experience in practice at Deloitte, working for multinational clients as well as clients within the asset management industry.

You might also like

Take a look at some of our bestselling courses