Corporation Tax: Refresher and Update

Revised and up to date for 2024/25. This course is a refresher for anyone working with tax for limited companies in the SME sector. Explore developments in company tax calculations, director and shareholder matters and group tax relief.

£100 +VAT

Corporation Tax: Refresher and Update

£100 +VAT

Corporation Tax: Refresher and Update

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Keep up to date with key developments in company tax calculations, tax relief and changes in accounting dates

- Make the most of losses, for your business and clients, by understanding specific legislation regarding loss calculations and tax relief claims

- Prevent abuses of directors’ powers in SMEs

- Understand different kinds of groups and how group tax relief works in practice

About the course

This course is a refresher and update for anyone working with tax for limited companies in the small and medium-sized enterprise sector and will add to your existing knowledge of the area. It explores some of the less familiar areas in corporation tax and the latest changes, updates and legislation involved.

The course covers key developments in company tax calculations, including expenses involved with tax adjustments. You’ll also review specific legislation regarding loss calculations and tax relief claims and the legislation concerning director and shareholder matters. The course also covers how group tax relief works in practice.

Please note, this course only covers Corporation Tax in the United Kingdom.

Contents

Corporation tax computations

Corporation tax: an overview

Recent changes to rates

Adjusted profit computations

Getting started

Legal and professional fees

The expense of entertaining

Vehicle leasing and property premiums

Changes in accounting dates

Pension contributions

Investment companies

Making the most of losses

Corporation tax losses

Pre- and post-April 2017 losses

Losses examined

Change of ownership

R&D repayable tax credits

Director and shareholder matters

Directors and shareholders: an overview

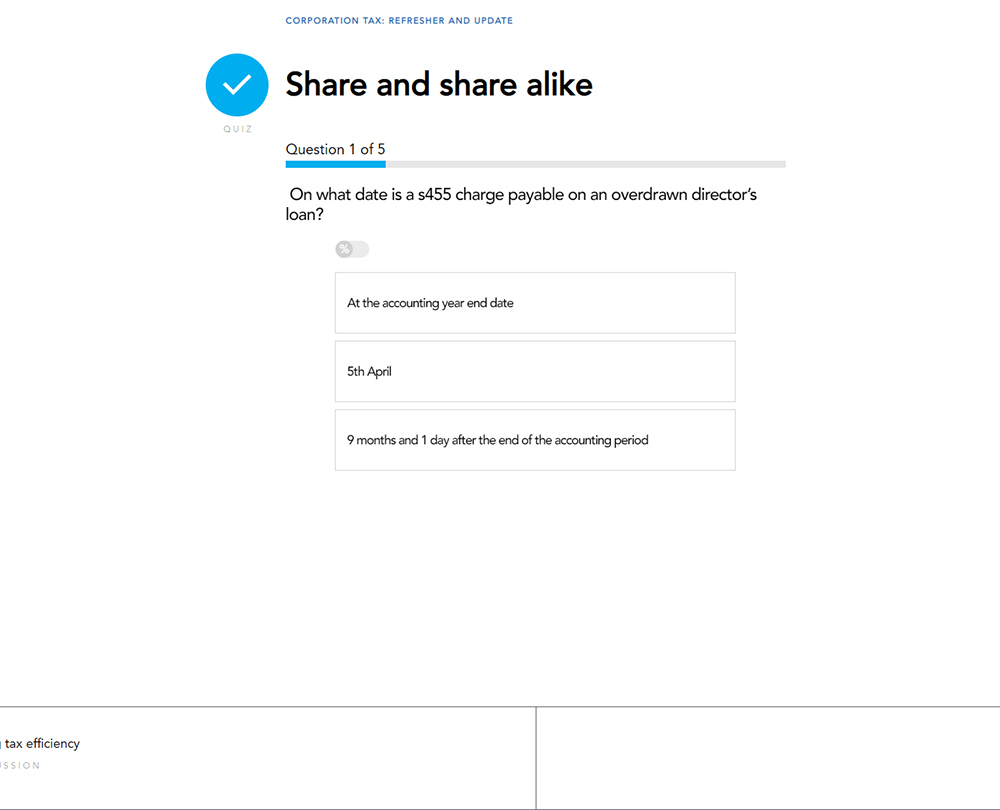

Director’s loans

Remuneration strategy

Share benefits

Anti-avoidance tactics

Groups

Corporation tax and groups

Group relief

Consortium relief

Moving assets within a group

De-grouping

Loan relationships between connected parties

How it works

Author

Andrew Law

Andrew Law has been in professional tax practice for over 30 years advising SME business on taxation matters and has advised on the sale and purchase of numerous businesses of all kinds and sizes.

You might also like

Take a look at some of our bestselling courses