Current Pensions and Finance Issues

Revised and up to date for 2024/25. Designed to get you up to speed with current pensions and finance issues, this course discusses the impact of recent changes to key areas including the upcoming state pension age increase, inheritance tax, and pension freedoms. It will also introduce you to automatic enrolment and various pension tax reliefs.

£100 +VAT

Current Pensions and Finance Issues

£100 +VAT

Current Pensions and Finance Issues

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Familiarise yourself with key themes and future proposals surrounding current pensions and finance issues

- Understand the current UK State Pension scheme

- Calculate the amount of the State Pension

- Explore the different pension freedoms that are currently available

- Effectively guide clients by recognising the key concepts and future of automatic enrolment

- Summarise the various allowances for pensions tax relief

About the course

Revised and up to date for 2024/25. In recent times, pensions systems and the legislation that governs them have undergone a dramatic upheaval, and savings are more vital than ever. With automatic enrolment and pension freedoms constantly evolving, the abolishment of lifetime allowance, and big changes to inheritance tax on the horizon, clients and employers will require advice in an increasingly technical area.

This course will get you up to speed with recent changes, as well as serving as a roadmap for upcoming developments. You will learn about automatic enrolment and the various allowances linked to pension contributions, and you will be able to advise on available reliefs. Having completed this course, you will be able to confidently provide assistance on a subject that’s on everyone’s minds.

Please note: This course applies to pensions in the the United Kingdom only.

Contents

Pensions themes

The importance of understanding pensions

Emergency savings and tax relief

Enough for retirement?

Possible future proposals

Pensions jargon buster

The state pension

The single-tier state pension

The triple lock

Increasing the state pension

State pension age

Sustainability of the state pension system

The issues with the state pension

Out with the old

Deferring, boosting, and changing

Winners and losers

Recent changes and their benefits

Pension freedoms

Pension freedoms and investment markets

The rules for pension freedoms

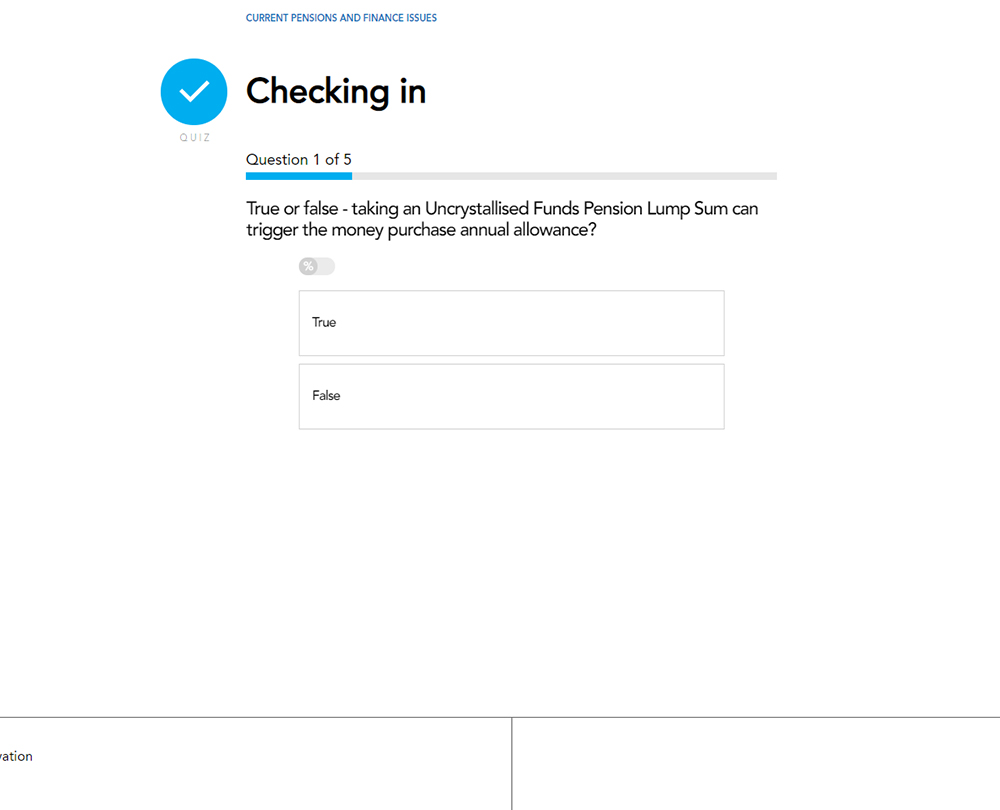

The money purchase annual allowance

Allowance changes

Understanding lifetime annuity

Pension income drawdown

Flexi-access drawdown

Pension death benefits

Passing on death benefits

The impact of pension freedoms

Automatic enrolment

Understanding automatic enrolment

The key concepts of automatic enrolment

Technical and compliance issues

Scheme options for employers

Choosing a certification rate

The Pensions Regulator

TPR and automatic enrolment

Directors and limited liability partners

The future of automatic enrolment?

Net pay arrangements

Pension tax relief

Key findings on pension tax relief

Tax reliefs to be aware of

Understanding annual allowance

High earners

Salary sacrifice

Salary sacrifice and pension provision

Personal allowance

How it works

Author

Rob Weaver

Rob Weaver BA (Hons) Has worked in the finance industry for over 25 years. He is a former Senior Pensions Consultant at a leading pensions provider. He currently works on a number of consultancy, training and coaching projects including the Level 7 Accountancy Apprenticeship (ICAEW, ACCA, CIMA) through Reed Business School.

You might also like

Take a look at some of our bestselling courses