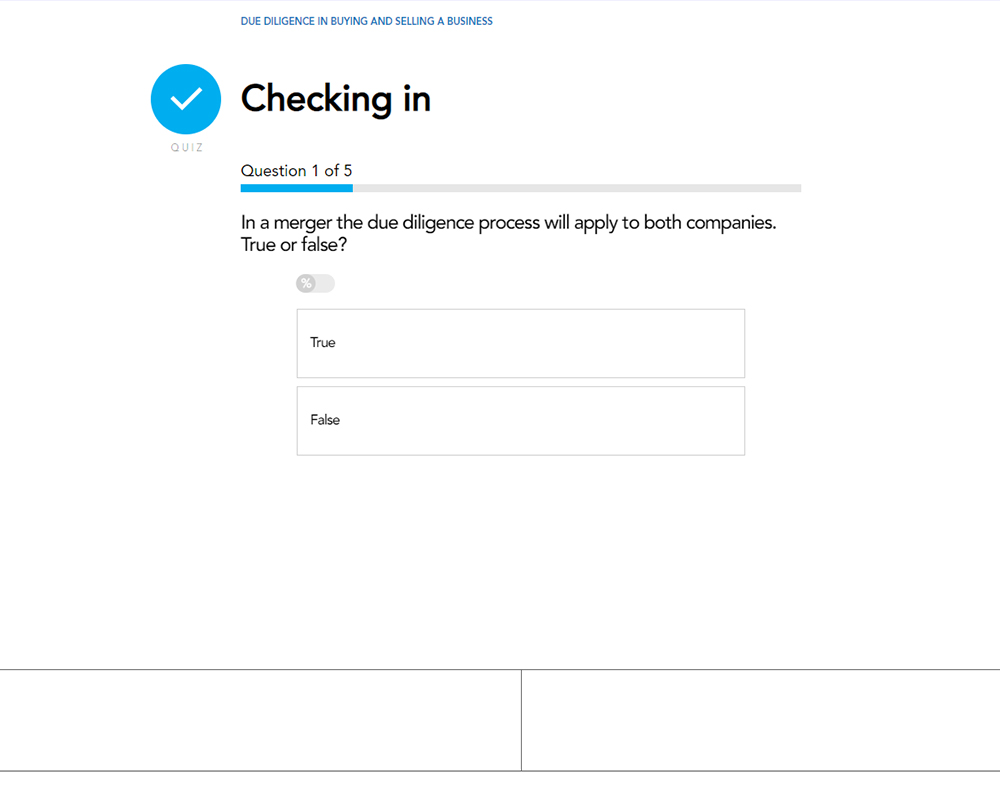

Due Diligence in Buying and Selling a Business

This course explores the process of due diligence from both the buyer and the seller’s perspective. You will learn the importance of due diligence for both parties and will consider the risks involved in buying or selling a business, and what you can do to minimise these.

£100 +VAT

Due Diligence in Buying and Selling a Business

£100 +VAT

Due Diligence in Buying and Selling a Business

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Understand the role of due diligence in the acquisition process, and the need for disclosure and reporting

- Identify the benefits of conducting due diligence as a buyer before purchasing a business

- Explore due diligence from the seller’s perspective and how to find the right buyer for your business

- Consider the risks involved in buying and selling a business, and why the process may sometimes fail

About the course

Buying a business is a major commitment and can be a daunting process. Due diligence is a process of discovery that can help you ensure that the business is what you want before buying it. Both buyers and sellers can benefit from the process before acquisition and should take the time to learn what risks are involved.

Explore the process of due diligence from both the buyer and the seller’s perspective, with this course. You will learn the importance of due diligence for both parties and will consider the risks involved in buying or selling a business, and what you can do to minimise these. You’ll also discover the due diligence process for the purchase and sale of online businesses.

Contents

Why we need due diligence

Timeline and context of a deal

What is due diligence?

Disclosing information

Important information when buying a business

Explaining hostile takeovers

Complications during a hostile takeover

Due diligence reporting

The main parts of a due diligence report

The buyer’s perspective

A big commitment

What is wanted from a due diligence investigation?

The main aims of a due diligence investigation

Financial due diligence

Preparing an analytical review

The role of management

Technology and IT

Dealing with HR and employees

Understanding risk management practices

Selling a business

Selling and due diligence

What and why are you selling?

Finding the right buyer

Looking for the right buyer

Considering corporate culture

The hubris hypothesis

A pre-sale tidy up

Preparing for due diligence

Warranties and indemnities

The limitations on warranties and indemnities

Risk and buying an online business

Evaluating risk

The main risks to stakeholders

Moving into a new market

Deciding to buy into a new market

Reasons for failure

Buying an online business

Key considerations

Customers and suppliers

How it works

Author

John Taylor

John is a Chartered Accountant who has spent many years advising small and medium-sized businesses across the North of England. John is the author of two industry standard textbooks: Millichamp – Auditing and Forensic Accounting. He has also written several auditing textbooks for AAT courses.

You might also like

Take a look at some of our bestselling courses