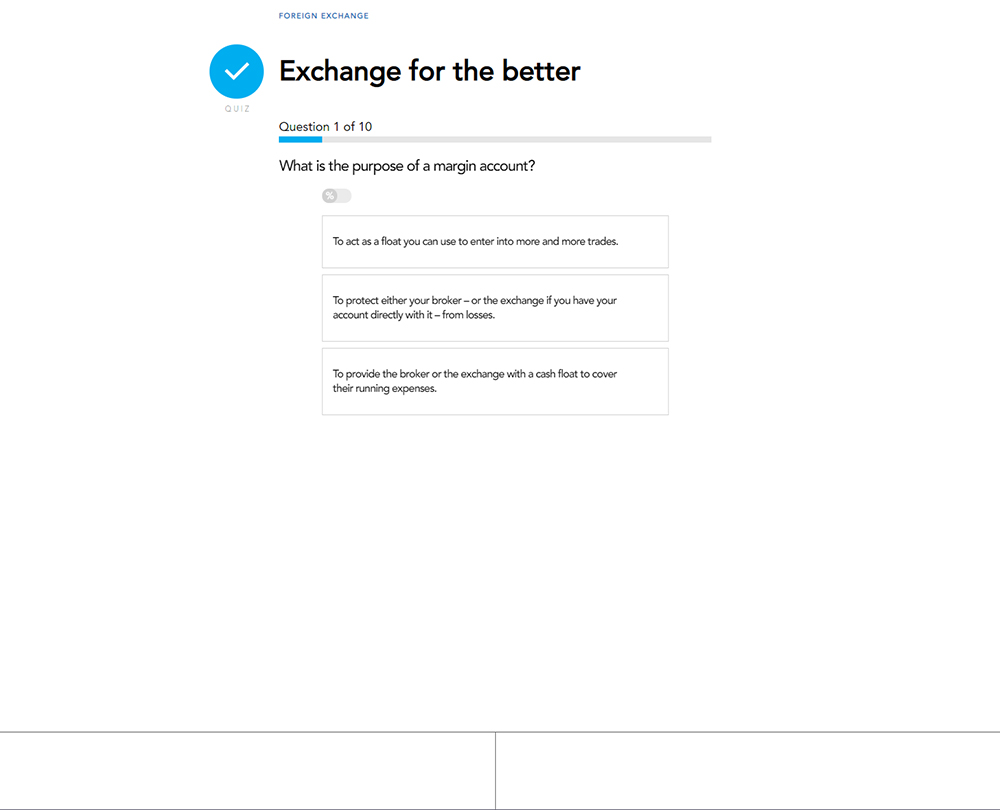

Foreign Exchange

Familiarise yourself with what the complex world of foreign exchange means for your organisation. Use this course to understand how to hedge risk to protect your organisation, and gain an awareness of the opportunities offered by foreign exchange.

£100 +VAT

Foreign Exchange

£100 +VAT

This course will enable you to

- Understand how foreign exchange risks arise, and how they can turn into profit or loss

- Familiarise yourself with financial contracts available for fixed exchanges of currency

- Appreciate the relationship between currency volatility and the price of options

- Advise on “over-the-counter” and “exchange-traded” modes of trading foreign exchange financial instruments for delivery in the future

- Discover different types of supplier of foreign exchange service along with some specialist new entrants

About the course

Many organisations have to deal in currencies different to their own base currency, whether this is through using foreign suppliers or accepting payment from customers overseas. Either way, this can introduce risks and complications. In order to advise your organisation and your clients, you need to understand the steps organisations can take to hedge against the risks and perhaps even reap some rewards.

This course offers a detailed insight into the world of foreign exchange. Get to grips with the risks to your organisation arising from foreign exchange and assess your options for minimising that risk. Learn about spot and forward transactions and why volatility between currencies plays a key role in determining the price of options. You’ll also compare and contrast the two main modes of trading foreign exchange financial instruments for delivery in the future.

Contents

Foreign exchange risks

How risk arises

Purchases and sales in foreign currency

Disguised exposures

Budgets and assumed rates

Economics of spot and forward

How contracts are priced

Spot transactions

Forward contracts

Pips in practice

Future foreign exchange contracts

Economics of options

Foreign exchange options

Call and put options

The risks of options

Size of the option premium

Options vs forwards: there is no free lunch

Over-the-counter and exchange-traded

Knowing the difference

Over-the-counter: Advantages and drawbacks

Futures and options exchanges

Exchange-traded instruments: Advantages and drawbacks

Buying and selling contracts

Types of provider

Fintech

Specialist payment firms

Risks of working with specialists

Types of client

Commercial banks

Financial market infrastructures

How it works

Author

Bob Lyddon

An experienced management consultant both privately and with PwC.

You might also like

Take a look at some of our bestselling courses