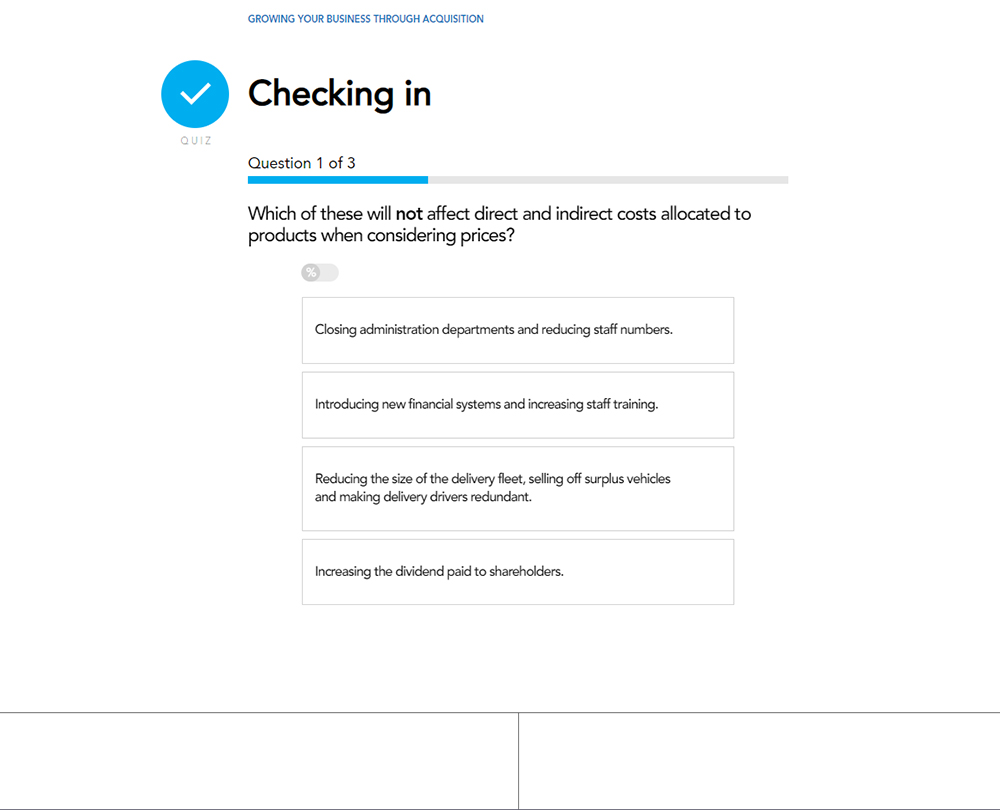

Growing Your Business Through Acquisition

Making the decision to grow your business through acquisition should not be one that is taken lightly. This course will guide you on how to grow your business through mergers and acquisitions and the pitfalls and issues to be aware of along the way.

£100 +VAT

Growing Your Business Through Acquisition

£100 +VAT

Growing Your Business Through Acquisition

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Consider whether a takeover or a merger is the right step for your organisation

- Understand how to value a company and finance an acquisition

- Identify the most appropriate ways to merge businesses and recognise the potential challenges involved

- Consider the issues arising from a takeover or merger from the viewpoint of customers, suppliers, and business assets

- Identify and apply the right accounting and finance processes

About the course

There are various options to consider when growing your business. This course focuses on expansion through buying another business or merging with a partner business. Whether it’s a merger or a takeover, expanding a business in this way requires a leap into the unknown; no matter how much preliminary investigation and negotiation you do, the full truth never emerges until the businesses are affiliated.

This course provides you with the tools and techniques you need to be able to understand how to grow your business and the pitfalls and issues to be aware of. This course will enable you to gain the knowledge and skills needed to successfully manage a merger or acquisition.

Contents

The right move?

The difference between takeovers and mergers

The difference between takeovers and mergers

Reasons for expanding your business

Making a big decision

When a takeover goes wrong

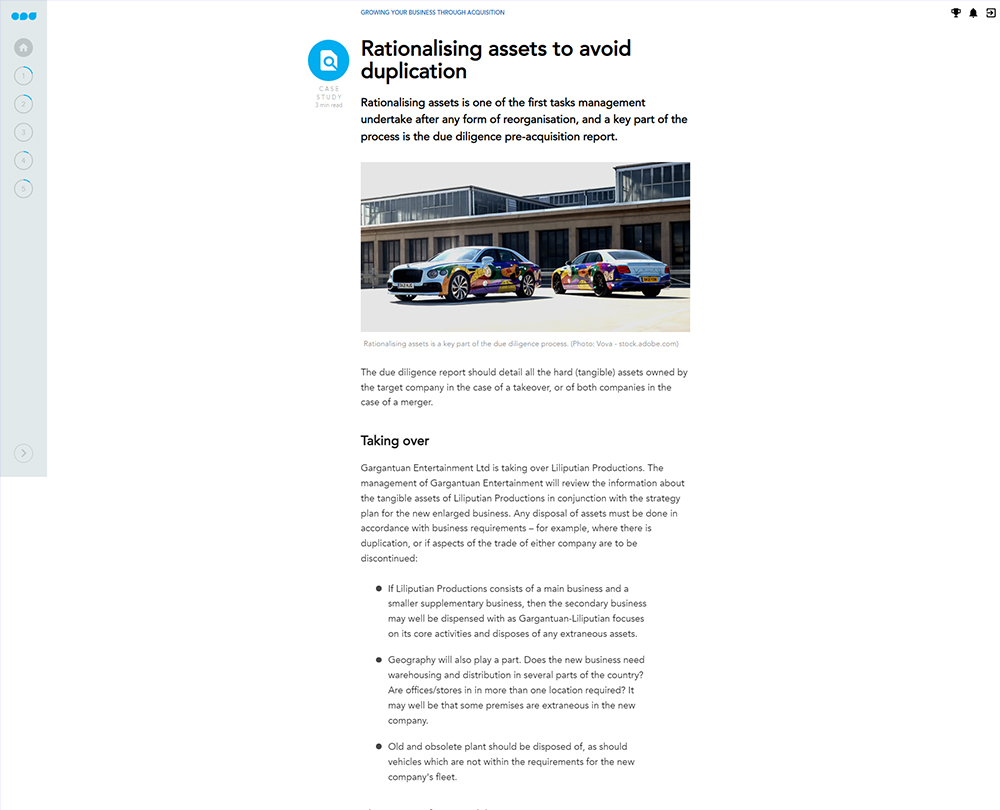

Explaining due diligence

Due diligence and the acquisition process

Financing the deal

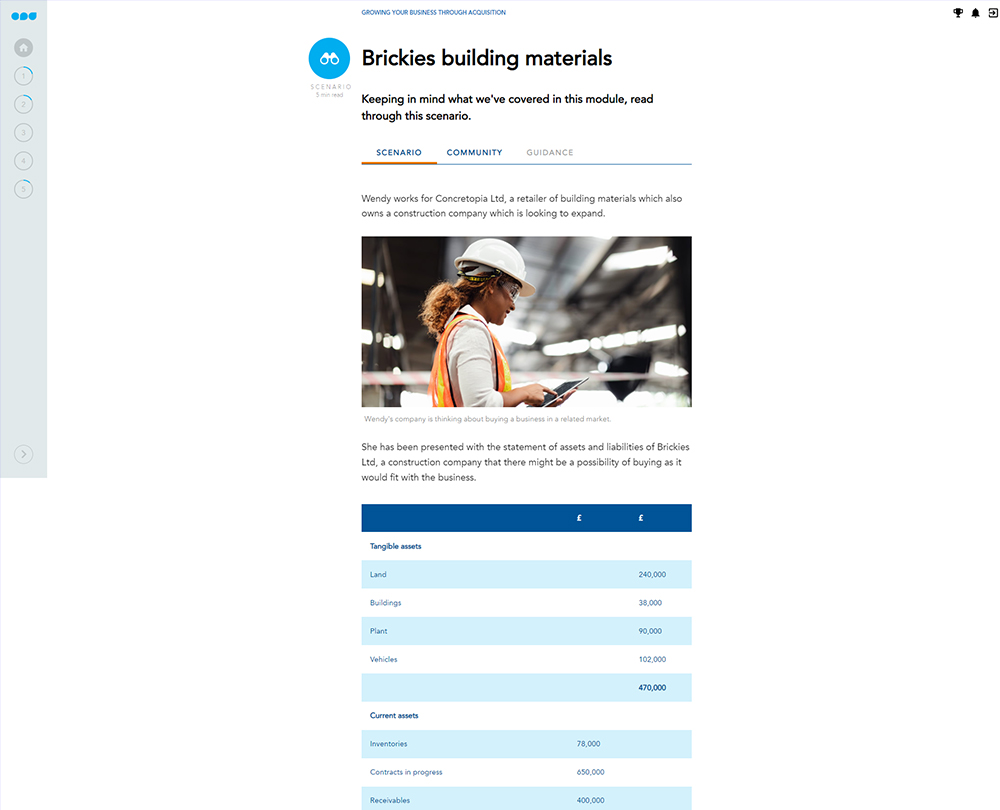

The cost of a takeover

The additional costs of a takeover

Understanding business valuation

The cost of borrowing and the risk premium

Reducing the risk premium

Mezzanine financing

Merging the businesses

Identifying synergies in operations

Merging employees

Dealing with management

Reducing costs post-takeover

Redundancies and cost savings

Understanding cultural blending

A clash of cultures

Identifying bottlenecks and problems

Customers, suppliers, and assets

Dealing with customers

Retaining customers following a merger/takeover

Understanding the management challenge

Managing your suppliers

Maintain a good working relationship with suppliers

Accounting and finance

What factors should you consider?

Merging MIS

Choosing a new system

The benefits of an effective management information system

Overheads and the effect on pricing

Revising the processes

Thinking about your processes

Cashflow planning

Taking write-offs and provisions

How it works

Author

John Taylor

John is a Chartered Accountant who has spent many years advising small and medium-sized businesses across the North of England. John is the author of two industry standard textbooks: Millichamp – Auditing and Forensic Accounting. He has also written several auditing textbooks for AAT courses.

You might also like

Take a look at some of our bestselling courses