IFRS: Key Accounting Policies and Other Reporting Considerations

This course provides a holistic approach to developing accounting policies that are coherent and faithful. It draws in diverse elements of the IFRS framework to present a full image of well written financial statements.

£100 +VAT

IFRS: Key Accounting Policies and Other Reporting Considerations

£100 +VAT

IFRS: Key Accounting Policies and Other Reporting Considerations

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Review and develop holistic and coherent accounting policies

- Get to grips with all the key standards on accounting policies: IAS 8, IAS 21, IAS 10 and IAS 24

- Know how to handle events after the reporting period

- Understand how accounting foreign exchange might potentially impact on both the statement of financial position and the statement of comprehensive performance

- Prepare financial statements on a going concern basis

- Familiarise yourself with IFRS 13 and its influence on other standards

About the course

This course provides a holistic approach to developing accounting policies that are coherent and faithful. It draws in diverse elements of the IFRS framework to present a full image of well written financial statements.

Now with a new module on IFRS 13: Fair Value Measurement, as well as video interviews with the authors and additional case studies, the course begins by looking in detail at the main source of guidance on accounting policies – IAS 8. It then takes you through other key issues in reporting including how to deal with foreign exchange transactions, how to handle events after the reporting date , related party transactions and measuring fair value.

Contents

Changes in policies

IAS 8 explained

Objective, scope and key definitions

Selecting accounting policies

Changing accounting policies

Changes in accounting estimates

Errors

Sources of confusion in IAS 8

Foreign exchange

IAS 21 explained

Objective, scope and key definitions

Functional currency in foreign operations

Accounting for functional currency

Exchange differences

Translating to the presentation currency

Events after the reporting date

IAS 10 explained

Objective, scope and key definitions

Spotting events after the reporting date

Adjusting events

Non-adjusting events

No longer a going concern

Disclosures

Related parties

IAS 24 explained

Objective, scope and purpose

Related parties

Related party transactions

Disclosures

Related party transactions in practice

Fair value

Objective, scope and key definitions

Defining fair value

Measuring fair value

The hierarchy

Disclosures concerning fair value

Other types of reporting

Other types of reporting explained

IFRS 8: Objective, scope and key definitions

IFRS 8: Disclosures

IAS 34: Objective, scope and key definitions

IAS 34: Condensed financial statements

IAS 34: Disclosures

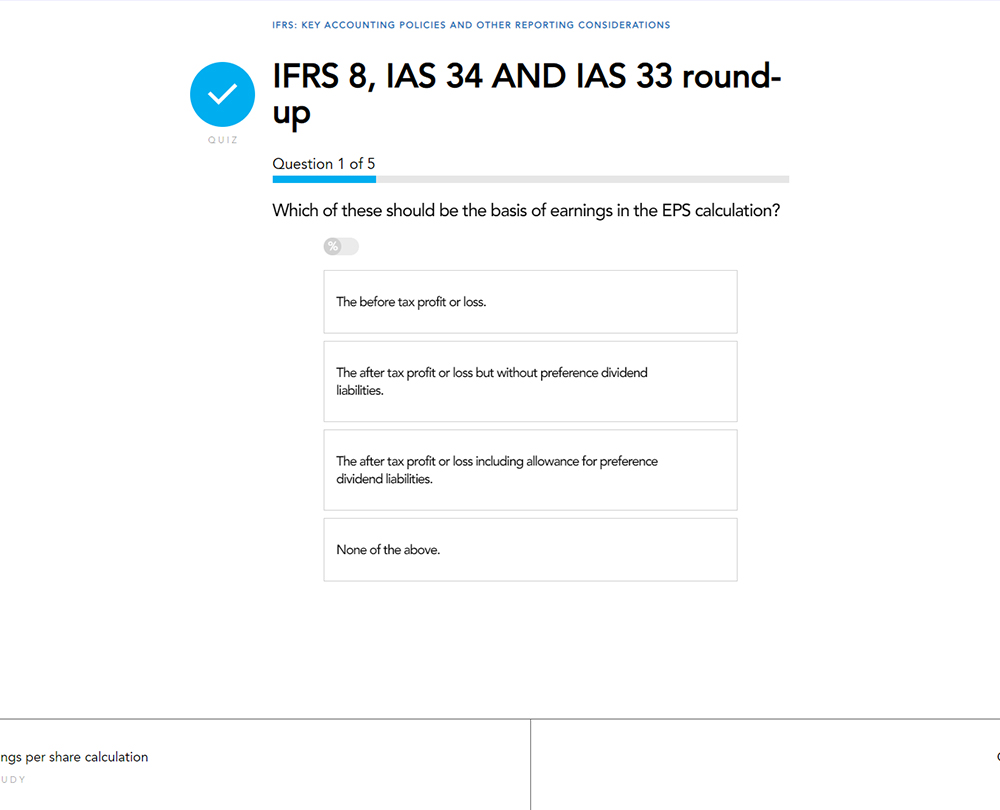

IAS 33: Objectives and scope

IAS 33: Basic measurements, calculations and disclosures

How it works

Author

Wayne Bartlett

Wayne is an internationally acclaimed speaker and trainer on all aspects of public and private sector accounting and auditing standards. He has been instrumental in helping to develop the profession internationally and has taken lead roles in the development of new professional bodies and the accounting profession in Mozambique and Rwanda, and been extensively involved in developing financial reporting in many countries across the globe.

You might also like

Take a look at some of our bestselling courses