IFRS: Non-Financial Assets (excluding PPE)

IFRS 16: Leasing has seen the biggest change to IFRS for some years and came into effect January 2019. This course includes updates on the new IFRS as well as bringing together the accounting, reporting and disclosure requirements for important non-financial assets.

£100 +VAT

IFRS: Non-Financial Assets (excluding PPE)

£100 +VAT

IFRS: Non-Financial Assets (excluding PPE)

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Gain a comprehensive understanding of the changes made to IFRS 16 Leasing

- Understand the accounting and reporting of inventories (IAS 2)

- Recognise and adhere to the different rules for tangible and intangible assets (IAS 38)

- Learn when to capitalise costs and when to write them off again profit or loss (IAS 23)

- Understand the specific rules surrounding investment properties (IAS 40)

About the course

IFRS 16 Leasing has had a major impact on the treatment of non-financial assets on the balance sheet of most companies, as well as having a knock-on effect on the treatment of borrowing costs.

Most business entities have significant assets other than property, plant and equipment to account for. Alongside leases, a thorough understanding of the Standards is critical whether you are reporting on physical inventories, intangibles, the capitalisation of borrowing costs, or work in progress.

This course brings together the accounting, reporting and disclosure requirements for these important non-financial assets under the IFRS regime.

Contents

Inventories

IAS 2 Inventories – Q&A

All about IAS 2

Measurement of inventories

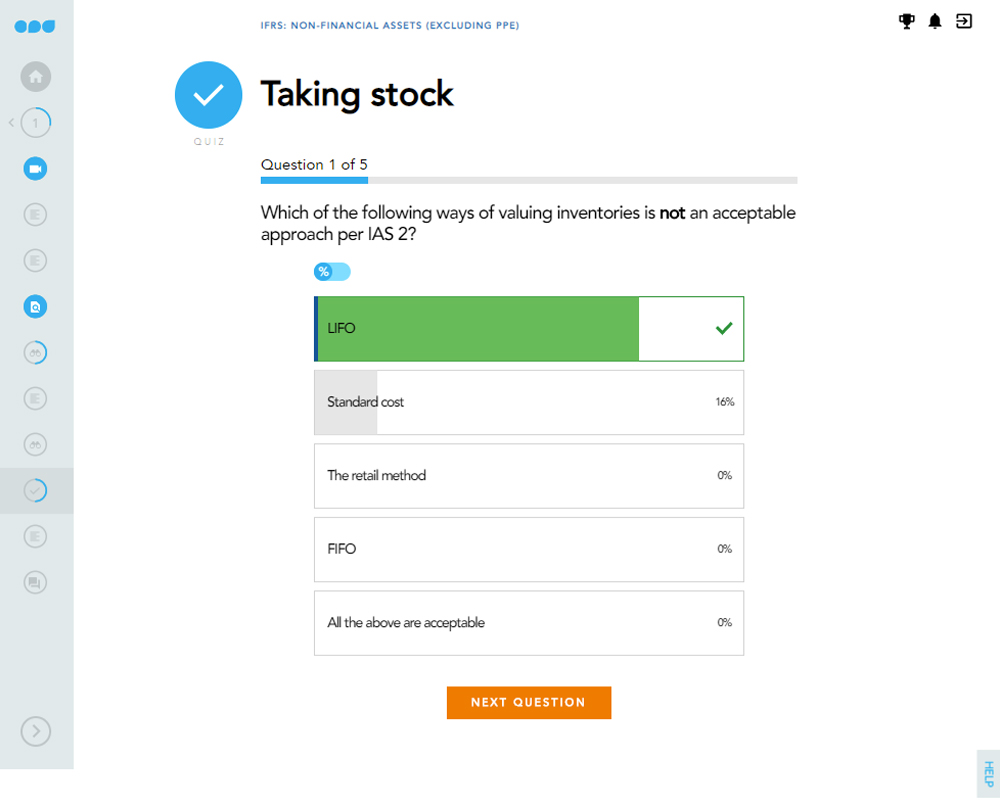

Net realisable value of inventory

Overcoming barriers

Intangible assets

IAS 38 Intangible Assets – Q&A

All about IAS 38

Recognition and measurement

Initial cost of an acquired intangible asset

Research and development expenditure

Valuing an intangible asset after recognition

Amortisation on an intangible asset

Intangible assets with indefinite lives

More on information systems

Leasing

IFRS 16 Leases – Q&A

IFRS 16 and IAS 17

Reasons for the changes

Impact of the changes

Potential complications

Exemptions from the new rules – Q&A

IFRS 16 and the principles-based framework

Borrowing costs

IAS 23 Borrowing Costs – Q&A

All about IAS 23

Recognising borrowing costs

Suspending or ceasing capitalisation of borrowing costs

Borrowing costs and assets

Investment properties

All about IAS 40

Investment property vs owner-occupied property

Measurement at the point of recognition

The fair value model

Changes in use

Transfers where investment property is carried at fair value

Disclosure requirements for IAS 40

IFRS resources

How it works

Author

Wayne Bartlett

Wayne is an internationally acclaimed speaker and trainer on all aspects of public and private sector accounting and auditing standards. He has been instrumental in helping to develop the profession internationally and has taken lead roles in the development of new professional bodies and the accounting profession in Mozambique and Rwanda, and been extensively involved in developing financial reporting in many countries across the globe.

You might also like

Take a look at some of our bestselling courses