IFRS: Property, Plant and Equipment

Property, Plant and Equipment (PPE) plays a crucial role in the financial statements of many entities. This course explains all the key accounting requirements and disclosures to enable you to make sound judgements as well as to understand the standards.

£100 +VAT

IFRS: Property, Plant and Equipment

£100 +VAT

IFRS: Property, Plant and Equipment

This course is not currently available. To find out more, please get in touch.

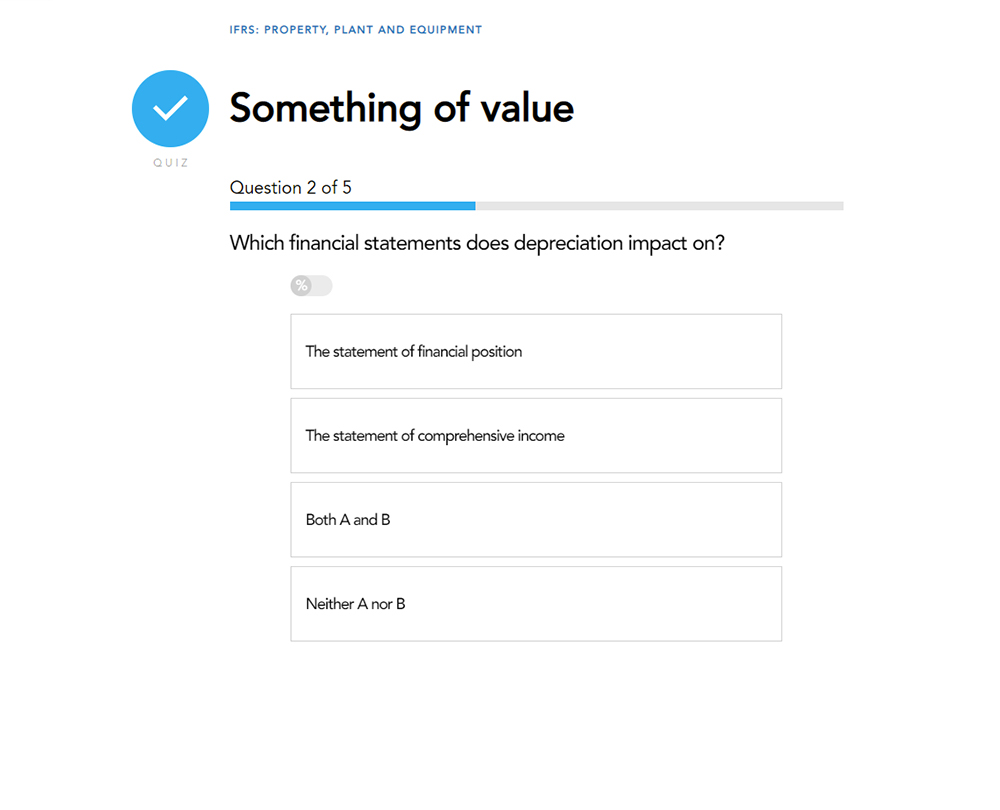

This course will enable you to

- Recognise what the overall rule for a PPE asset is

- Understand how the cost of an asset is charged against profits in a way that reflects its usage

- Define key concepts in various PPE disclosures such as impairments and business combinations

- Decide if an asset is impaired and if so, what actions to follow

- Identify key rules with relation to estimating future cash flows, and recognising and measuring impairment losses

About the course

Property, Plant and Equipment (PPE) plays a crucial role in the financial statements of many entities. They often make up one of the largest items on the statement of financial position, and also play a big part in the statement of comprehensive income through the charging of depreciation and impairment.

This course looks at accounting for PPE through IAS 16, which covers PPE specifically, and IAS 36, which covers the connected issue of impairment.

Contents

Recognition rules

What are the recognition rules for PPE?

Objective and scope of IAS 16

Capitalisation thresholds

Initial PPE measurements

What is the valuation of assets?

Depreciation

What is depreciation?

Depreciation

What are the depreciation methodologies?

Reviewing asset lives and residual value

Accounting for depreciation

Disclosures

What are the PPE disclosure requirements?

Business combination

What other disclosure requirements are there?

Disclosures relating to revaluations

Impairments

What are impairments?

Overall objective of IAS 36

How do you know if an asset is Impaired?

Calculating value in use

Estimating future cash flows

Measuring an impairment loss

How it works

Author

Wayne Bartlett

Wayne is an internationally acclaimed speaker and trainer on all aspects of public and private sector accounting and auditing standards. He has been instrumental in helping to develop the profession internationally and has taken lead roles in the development of new professional bodies and the accounting profession in Mozambique and Rwanda, and been extensively involved in developing financial reporting in many countries across the globe.

You might also like

Take a look at some of our bestselling courses