IFRS: Structure of Financial Statements

Gain a clear understanding of how the IFRS framework shapes financial statements. This course explains the structure, purpose and key principles behind IFRS reporting.

£100 +VAT

IFRS: Structure of Financial Statements

£100 +VAT

IFRS: Structure of Financial Statements

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Apply the principles of the IFRS regime as laid out in the conceptual framework

- Follow the general rules and criteria for financial statements prepared under IFRS

- Understand how IFRS 18 will replace IAS 1

- Recognise cash transactions and classify cash flow activities as defined by IAS 7

- Meet the requirements for interim financial statements under IAS 34

About the course

Understanding the IFRS regime starts with the big picture. This course introduces the IFRS conceptual framework – the foundation on which all standards are built – and explains how it helps preparers and users of financial statements make informed decisions about recognition, measurement, presentation and disclosure.

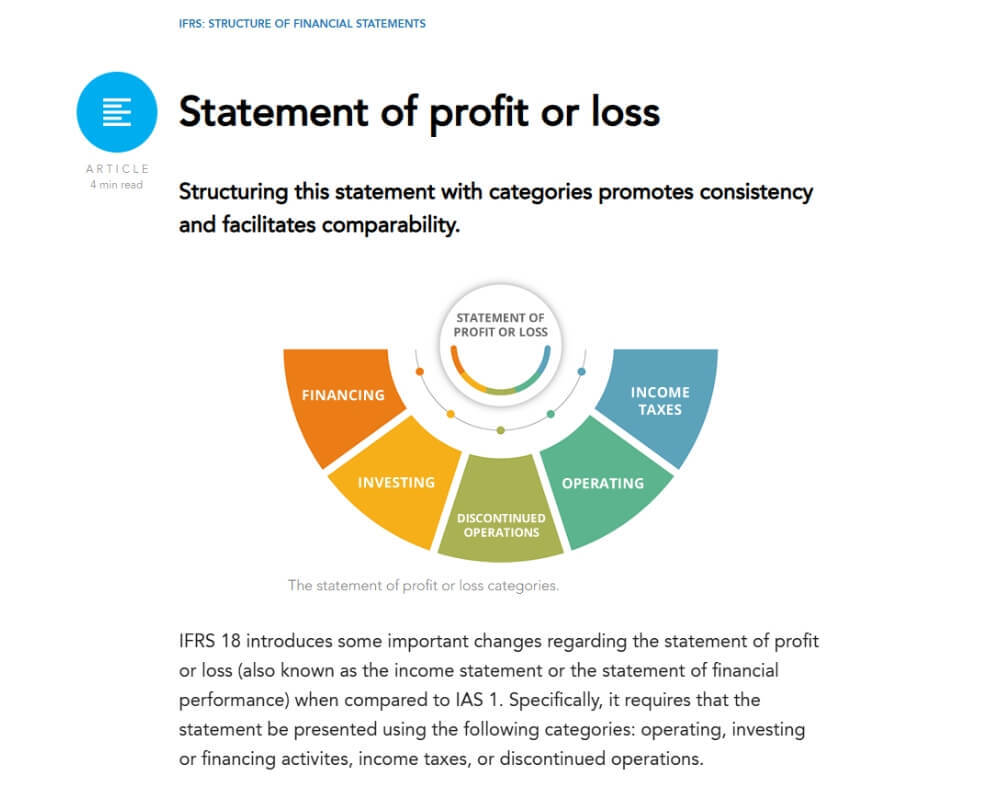

You’ll explore three key standards that structure financial statements under IFRS. IFRS 18, which replaces IAS 1, outlines general presentation and disclosure principles and is critical for anyone preparing annual statements. IAS 7 defines how to classify and present cash flows, and IAS 34 sets minimum requirements for producing reliable interim financial reports. Together, they provide essential guidance for structuring both full-year and interim reporting cycles.

This course will give you the knowledge to interpret and apply these core standards with clarity. Equip yourself to produce compliant financial statements, explain their structure and content to others, and stay up to date with recent developments across the IFRS landscape.

Contents

The conceptual framework

The basis of the conceptual framework

The structure of the conceptual framework

General purpose financial reporting

Qualitative characteristics

Financial statements and the reporting entity

Recognition, derecognition and measurement

Judging uncertainty

Presentation, disclosure and capital

IFRS 18 Primary financial statements

IFRS: bigger and better

IFRS 18 versus IAS 1

Objectives and scope

Aggregation and disaggregation

Statement of profit or loss

Statement of comprehensive income

Spotlight on management performance

Management performance reporting

Statements of financial position and changes in equity

Disclosure notes

IAS 7 Statement of cash flows

Objectives, scope and presentation

Classifying activities

Method management

Foreign currency

Interest and dividends

Deciding on disclosures

Disclosures and other issues

IAS 34 Interim financial reporting

Objectives and scope

Taking stock

The minimum requirements

Recognition and measurement

Disclosures

The small matter of disclosures

How it works

Author

Wayne Bartlett

Wayne is an internationally acclaimed speaker and trainer on all aspects of public and private sector accounting and auditing standards. He has been instrumental in helping to develop the profession internationally and has taken lead roles in the development of new professional bodies and the accounting profession in Mozambique and Rwanda, and been extensively involved in developing financial reporting in many countries across the globe.

You might also like

Take a look at some of our bestselling courses