IFRS: The Structure of Financial Statements

This course explains the design of financial statements within International Financial Reporting Standards (IFRS) and considers their key components, as well as what each statement is trying to achieve.

£100 +VAT

IFRS: The Structure of Financial Statements

£100 +VAT

IFRS: The Structure of Financial Statements

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Understand the principles and aims of the IFRS regime

- Comprehend the general rules regarding financial statements prepared under IFRS

- Gain an overview of the reports

About the course

Do you understand the fundamental principles underlying IFRS? Without a clear understanding of the essential background to the IFRS regime as a whole, it is impossible to fit the individual IFRSs into the bigger picture.

Now enhanced with additional case studies and video interviews with the author, this course explains the design of financial statements within International Financial Reporting Standards (IFRS) and considers their key components, as well as what each statement is trying to achieve. You will recognise the information that needs to be included as well as the concepts of fair presentation, accruals and going concern, building to a full understanding of the core framework into which the IFRSs fit.

Contents

The aims of IFRS

What is IFRS?

General purpose financial statements

IFRS regime: Basic principles

Key financial statements

Changes to IFRS

Overcoming barriers

General rules

Moving to IFRS

The purpose of financial statements

Information that must be included

The going concern concept

The financial statements under IFRS

The statement of financial position

The statement of financial position explained

Statement of financial position: The aims

Information in the statement of financial position

Current and non-current assets

Current and non-current assets and liabilities

Current liabilities

Disclosures

The statement of comprehensive income

The statement of comprehensive income explained

Statement of comprehensive income

Non-controlling interest

What is comprehensive income?

Types of income included

Challenges to overcome

Other financial statements and disclosure notes

Other financial statements explained

The statement of changes in equity

The statement of cash flows

Structure of the statement of cash flows

Disclosure notes explained

Structure of the notes

Accounting policies in the financial statements

Sources of estimation uncertainty

IAS 1 and capital

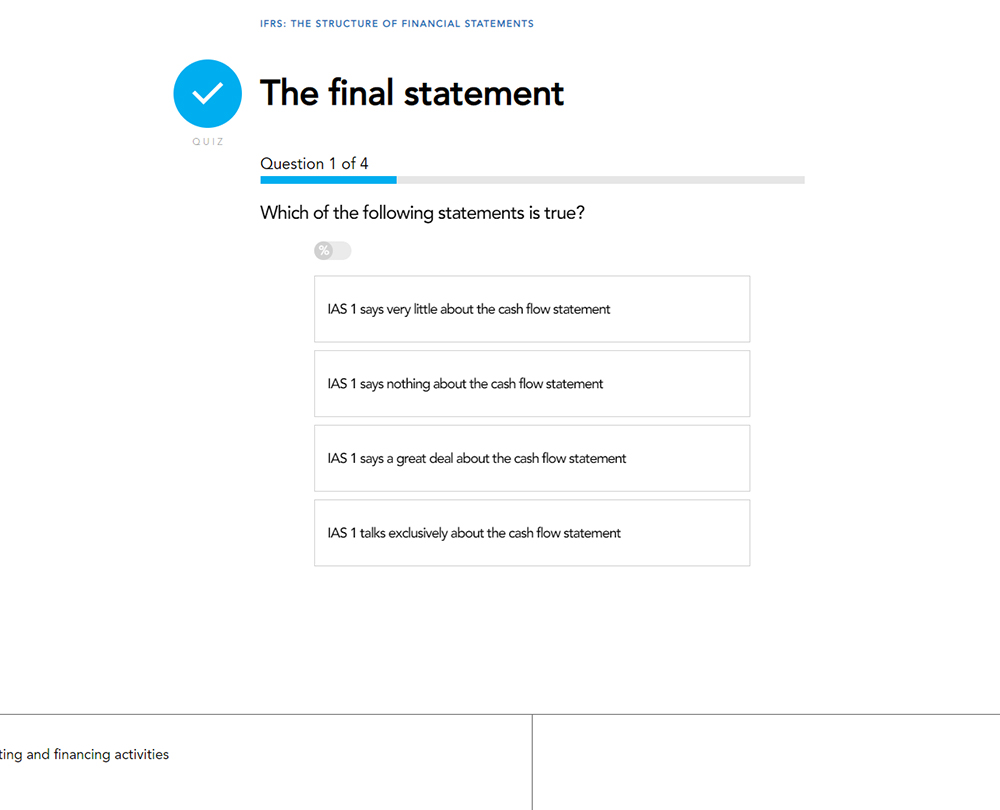

Operating, investing and financing activities

How it works

Author

Wayne Bartlett

Wayne is an internationally acclaimed speaker and trainer on all aspects of public and private sector accounting and auditing standards. He has been instrumental in helping to develop the profession internationally and has taken lead roles in the development of new professional bodies and the accounting profession in Mozambique and Rwanda, and been extensively involved in developing financial reporting in many countries across the globe.

You might also like

Take a look at some of our bestselling courses