Inheritance Tax

Revised and up to date for 2025/26. This course is an introduction to UK Inheritance Tax and includes the treatment of potentially exempt transfers, agricultural and business property relief as well as the use of trusts.

£100 +VAT

Inheritance Tax

£100 +VAT

This course will enable you to

- Establish whether an estate is subject to Inheritance Tax

- Calculate the scale of the tax likely to be payable

- Understand the primary reliefs available

- Identify common planning steps to alleviate the tax exposure

About the course

As an accountant, your role in inheritance tax (IHT) is the strategic structuring of a client’s wealth and business interests. However, this can be complicated, not only because IHT has a language all of its own but because there is a lot to get to grips with. From IHT liability and property reliefs, to further planning opportunities using trusts. There is a lot you will need to know to guide your clients.

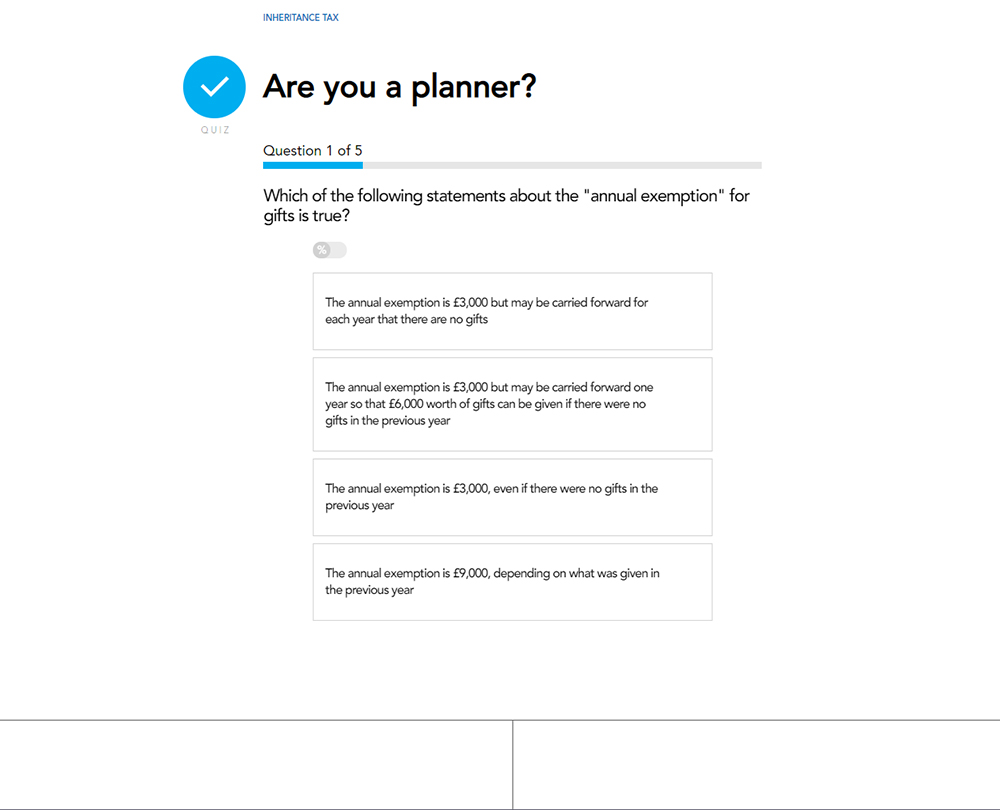

In this course, you will get an introduction to UK inheritance tax, and the various issues surrounding it. This includes the treatment of potentially exempt transfers, the ways in which agricultural property relief and business property relief can be maximised, and the use of trusts. You will also be learning about the various exemptions from inheritance tax, and how the seven-year waiting time can affect this.

Please Note: This course only covers UK tax law

Contents

IHT scope

Inheritance Tax: the basics

Key vocabulary

Long-term resident

What is domicile?

Assets subject to IHT

PETs

The residence nil rate band

Property relief

The main types of relief

Agricultural property

AR rates

Business relief

BR rates

Other reliefs and opportunities

Charity and other reliefs

Gifts to charities

Gifts exempt from IHT

Gifts of income

Tax preferred investments

Trusts

Using trusts for IHT

What is a trust?

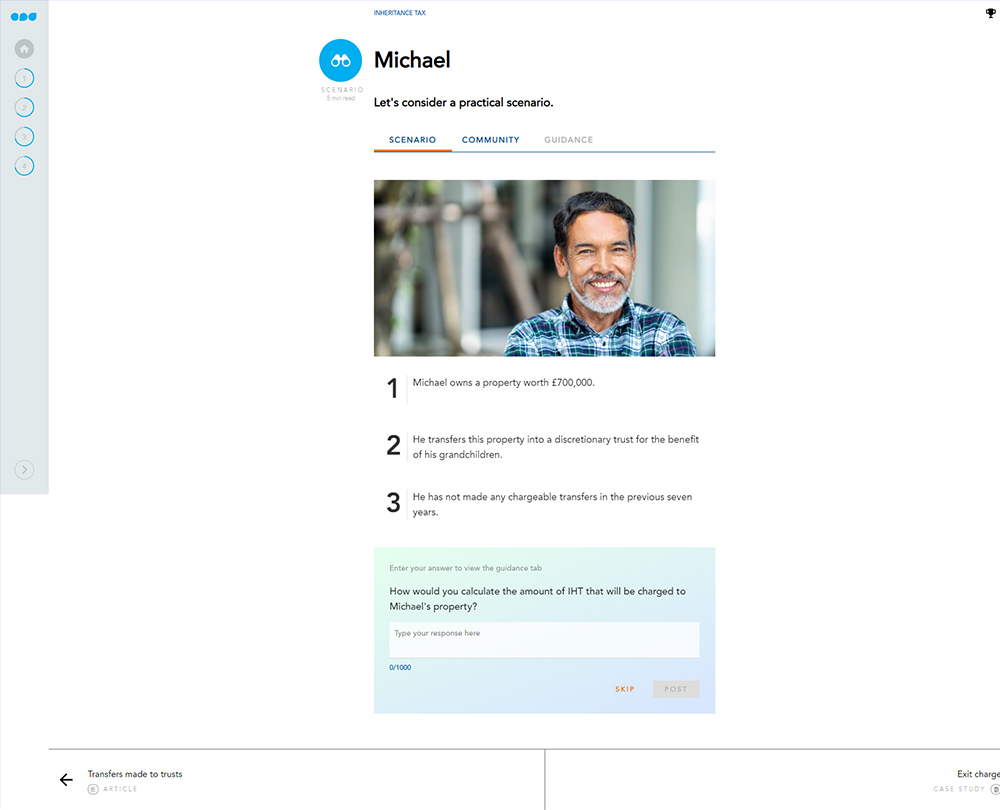

Transfers made to trusts

Trusts and IHT planning

CGT holdover relief

Flexible spouse trusts

How it works

Author

Andrew Law

Andrew Law has been in professional tax practice for over 30 years advising SME business on taxation matters and has advised on the sale and purchase of numerous businesses of all kinds and sizes.

You might also like

Take a look at some of our bestselling courses