Insolvency for Accountants

Economic turbulence and cash flow pressures continue to drive the insolvency landscape, and accountants are increasingly playing a key role. This course enables you to spot signs of business failure and equips you to help with turnaround, and understand your role, if the insolvency process is necessary.

£100 +VAT

Insolvency for Accountants

£100 +VAT

Insolvency for Accountants

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Understand the accountant’s role in insolvency.

- Spot the warning signs and know the right time to call an insolvency or turnaround expert.

- Understand the range of options if a turnaround effort fails.

- Trace domestic and international assets, using forensic technology where appropriate.

- Understand the regulation and the ethical codes associated with insolvency.

About the course

Economic turbulence and cash flow pressures are having a huge impact on the insolvency landscape, and accountants are increasingly playing a key role. The earlier you can spot signs, and intervene when a business is going into decline, the better the chances of bringing a struggling business back to health.

This course will help you identify the factors that can lead a business to fail and help you spot the early warning signs. It looks at ways to rescue a company but, most importantly, it outlines when you need to call in the insolvency experts, even if that’s not what the directors want to hear. Once in the insolvency process, this course outlines your role as an accountant, and how you can support the process and your client.

Finally, a clear understanding of the regulation surrounding insolvency, will ensure you act ethically, and with integrity, even in difficult situations.

Contents

Debt and insolvency </summaryInsolvency risk How insolvency arises A brief history of insolvency Risk appetite>

Warning signs

Ignoring the signs

Pre-insolvency

The point of insolvency

Keeping your eyes peeled

Red flags

Insolvency processes

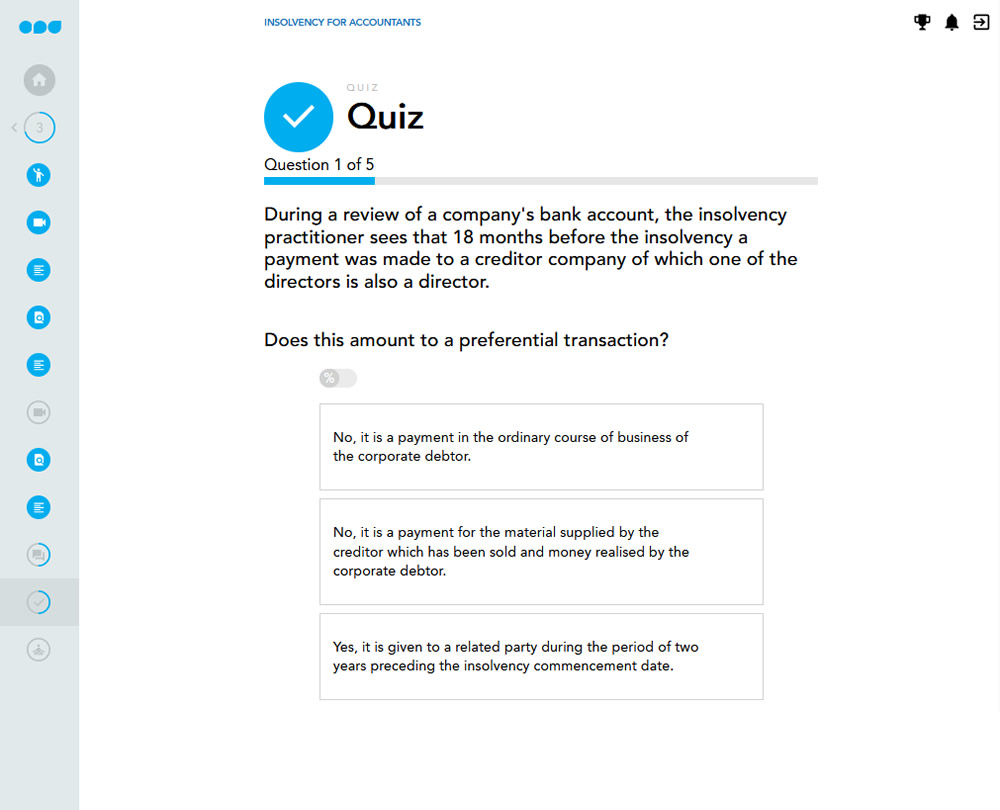

Insolvency vs turnaround

Turnaround strategy

Struggling companies

A focus on directors

Assessing creditor claims

Asset tracing

Hide-and-seek

Following the money

Internal fraud

Cross border situations

Supply chains

International insolvency regimes

Centre of main interests

Ethical considerations

Accounting or insolvency ethics?

Proof of personal gain

Conflicts of interest

The view from outside the profession

How it works

Author

Carol Baker

Carol Baker is Editor-in-Chief at Credit Control Journal and Asset & Risk Review, IT for CEOs & CFOs, and Property Finance & Lifestyle. Carol has been a journalist for a number of years including for ICAEW, the Financial Times, and the Guardian and often works alongside others to uncover corporate financial frauds.

You might also like

Take a look at some of our bestselling courses