International Anti-Money Laundering

Are you familiar with the regulation on tackling money laundering and the financing of terrorism in the global financial system? This course explores the regulatory system within global finance designed to eliminate money laundering and to counter the financing of terrorism.

£100 +VAT

International Anti-Money Laundering

£100 +VAT

International Anti-Money Laundering

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Recognise, understand, and minimise the risk to your organisation and clients of money laundering

- Understand the AML/CFT regulatory system across the world

- Identify who is an ‘obliged entity’ and their main duties

- Follow the process of normal due diligence

- Understand the process of enhanced due diligence and what to do if a customer is ‘high risk’

About the course

Anti-money laundering (AML) and countering the financing of terrorism (CFT) is an increasingly important area for accountants. A thorough understanding of the regulatory system within global finance will help you minimise risk for your organisation and your clients.

This course takes an in depth look at the regulatory system within global finance designed to eliminate money laundering and to counter the financing of terrorism. It gives you everything you need to understand this complex but important subject including information on Financial Action Taskforce (FATF), obliged entities, what would be considered normal and enhanced due diligence and much more.

Contents

Aims and substance

Fighting financial crime

Regime objectives

Sanctions and embargoes

National law-making

Sources of advice

Main duties of an obliged entity

Obliged entities

Who is an obliged entity?

Internal AML/CFT organisation

Due diligence

A risk-based approach

Normal due diligence

Normal due diligence

Customer due diligence

Non-natural legal persons

Politically exposed persons

Enhanced due diligence

Enhanced due diligence

What does EDD consist of?

Practical examples of EDD

EDD and PEPs

Black holes

Black holes

Validating authenticity

High risk countries

Trusted third parties

Electronic identity

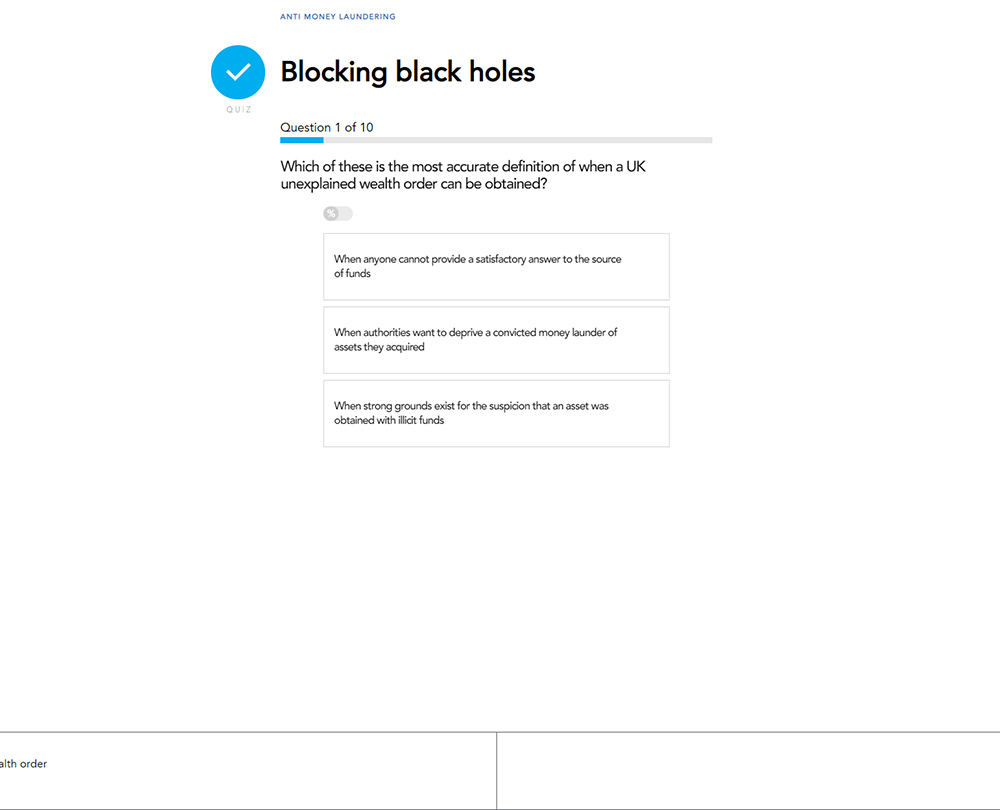

Unexplained wealth order

How it works

Author

Bob Lyddon

An experienced management consultant both privately and with PwC.

You might also like

Take a look at some of our bestselling courses