Periodic Review: A Case Study Approach

The FRC’s recent periodic review amendments have specific ramifications for those preparing financial statements in accordance with FRS 102. This course takes a case study approach, working through a variety of scenarios and outlining the kind of calculations that may be needed.

£100 +VAT

Periodic Review: A Case Study Approach

£100 +VAT

Periodic Review: A Case Study Approach

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Understand what first-time adoption of the key new policies might entail

- Recognise most leases on-balance sheet and remove any distinction between finance and operating leases

- Explain how revenue recognition rules have changed and apply the comprehensive five-step model

- Keep track of issues that may impact cash flow statements, including supplier finance arrangements and disclosures

- Correctly account for a business combination and any associated goodwill

About the course

The Financial Reporting Council (FRC) recently completed its periodic review of accounting standards, and new editions were published in September 2024. The amendments become effective for accounting periods commencing on or after 1 January 2026. There are significant changes to the accounting treatments for leases and revenue recognition, and the preparation of cash flow statements and consolidated financial statements is also impacted.

This course walks you through the key changes introduced in the updated standards, focusing on FRS 102 and related guidance. Using a series of practical case studies, it shows how the revised requirements apply in real-world contexts, including leases, revenue, cash flows, and group accounts, so you can clearly see how the changes affect reporting in practice.

By working through real examples, you’ll build a solid understanding of the new standards and how to apply them with confidence. The course provides the clarity you need to make informed decisions and ensure your reporting remains fully compliant as the changes take effect.

Contents

Leasing

All change

Scope of the new requirements

Exceptions to the rules

Exemptions from on-balance sheet recognition

Revenue recognition

Background to the amendments

Reframing revenue recognition

The five-step model approach

Know your business

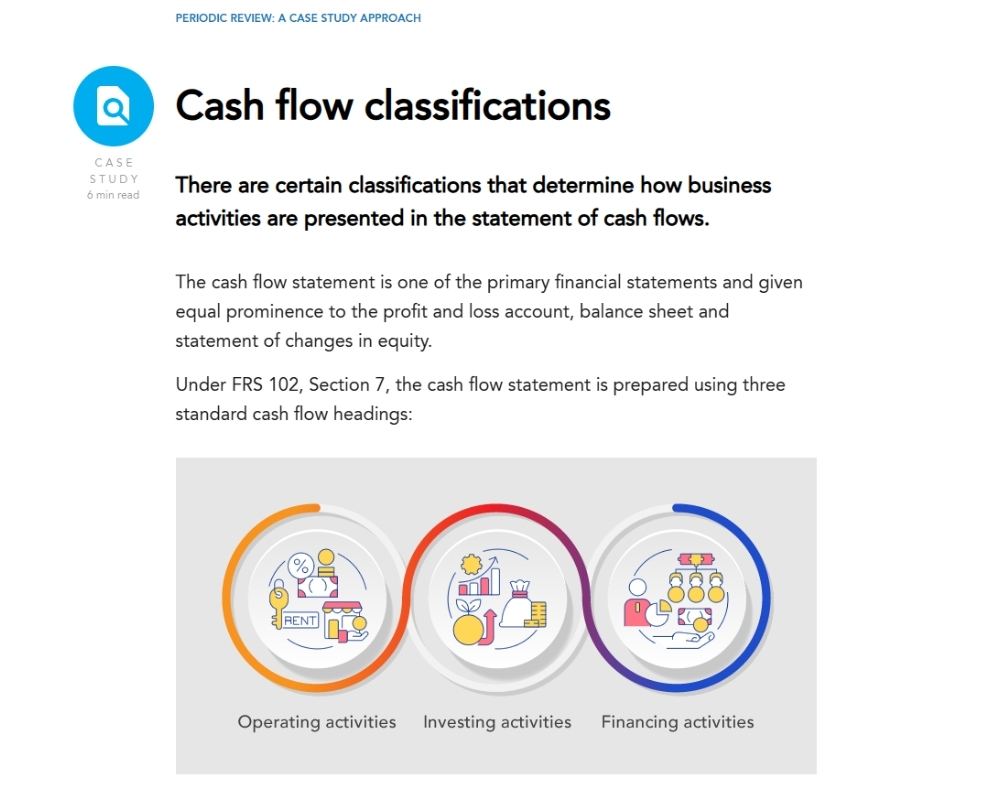

Cash flow statements

Scope of FRS 102, Section 7

Change across the board

Supplier finance arrangements

Common cash flow problems

Business combinations and goodwill

Clarifying the rules on combinations

Accounting for a business combination

The purchase method – steps 1-4

The trouble with goodwill

Periodic review amendments

How it works

Author

Steve Collings

Steve is Director at Leavitt Walmsley Associates, a firm of Certified Chartered Accountants. He is an internationally recognised speaker, writer and commentator on all matters to do with financial reporting and auditing. Steve is a prolific author, having written over 25 books and currently represents the North West of England on ACCA”s Practice Network Panel.

You might also like

Take a look at some of our bestselling courses