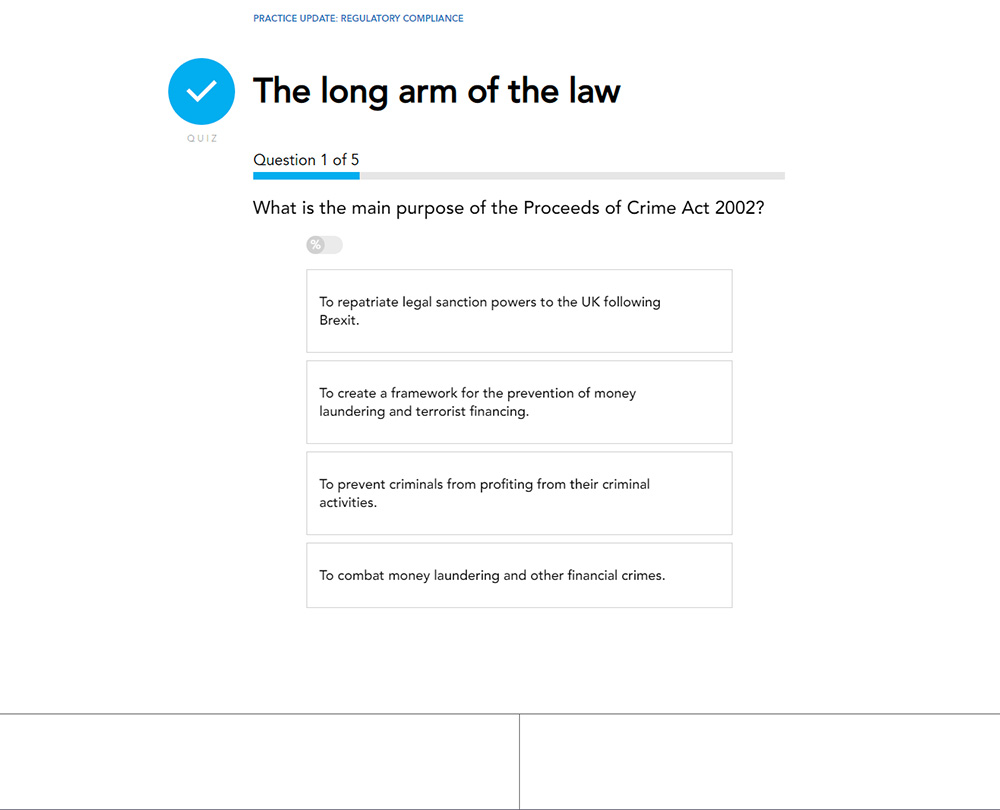

Practice Update: Regulatory Compliance

Revised and up to date for 2025. Accountants in practice are required to comply with some key UK regulations. This course gives you an insight into the UK’s regulatory framework and how to follow it to help tackle money laundering, bribery, financial crime and data protection.

£100 +VAT

Practice Update: Regulatory Compliance

£100 +VAT

Practice Update: Regulatory Compliance

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Deploy anti-money laundering (AML) solutions to ensure compliance with UK regulations.

- Ensure your firm complies with bribery and corruption laws.

- Understand the UK legal and regulatory financial framework in order to safeguard you and your practice.

- Adhere to data protection regulations to safely secure and hold client data.

About the course

Being a good accountant means going beyond just complying with standards, there is also the matter of the law! It’s crucial for you to stay up to date with a range of legal aspects. This is especially true for the UK’s regulatory framework concerning anti-money laundering, counter terrorist financing, and anti-bribery, as well as data protection.

This course looks at each of these areas and, by considering the policy-making framework, the role of the regulator and law enforcement, helps you protect your practice and your clients. The course is an overview of regulatory compliance, it is not advisory. It also covers data protection regulations concerning how you remain compliant when managing and collecting data.

Please Note: This course only covers UK regulation

Contents

Anti-money laundering

Keeping regulated

Money laundering and terrorist financing

AML regulation

What’s this got to do with me?

UK regulations

Regulating AML

Understanding KYC

The risk-based approach

Breaking the rules

Record-keeping and reporting

The importance of data

The future

Lessons from the real world

Bribery and corruption

The risk

The history of anti-bribery laws

How the law works

Protecting from bribery

Implementing policy

Assessing the risk

Understanding the red flags

Consequences

It’s not just bribery!

Creating an anti-bribery culture

Financial crime legislation

Accountants and the law

The Proceeds of Crime Act 2002

The Terrorism Act 2000

The UK Money Laundering Regulations 2017

The UK Bribery Act 2010

The Criminal Finances Act 2017

The Sanctions and Money Laundering Act 2018

The Economic Crime (Transparency and Enforcement) Act 2022

A steady ship

Data protection

Being aware of data protection

Data protection in the privacy age

Accountants and data protection

It’s about more than just the GDPR

Data protection for individuals

A changing world

Data protection in the EU

AI and data protection

UK GDPR

Taking action

Going forward

How it works

Author

Michael Harris & Becky Reid

Becky Reid works with small- and medium-sized organisations, helping them to maintain, improve and grow their digital marketing activities. Michael Harris is an independent financial crime risk consultant at FCC Consulting, and works with technology and data companies who provide anti-money laundering and anti-bribery compliance solutions.

You might also like

Take a look at some of our bestselling courses