Preventing Financial Crime

Understand the various types of financial crime and the controls that can be used to limit the opportunities for fraudsters to commit them. Look at how to create the right culture within an organisation to discourage collusion in fraud and encourage reporting and disclosure.

£100 +VAT

Preventing Financial Crime

£100 +VAT

Preventing Financial Crime

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Understand the range of financial crimes which can be committed, as well as the motives and profiles of those likely to commit them

- Gain comprehensive skills in risk management and improve your assessment of risk factors

- Identify how to properly approach and report financial crimes

- Develop an effective policy for IT system risks

- Know how to influence ethical behaviour and create the right kind of corporate culture

About the course

Financial crime can be committed by anyone in an organisation, who is motivated by some need or desire, prepared to rationalise their actions, and thinks they won’t get caught. It can also be committed by external sources through malware attacks, therefore having an understanding of this area is crucial for protecting your organisation.

This course will enable you to understand the various types of financial crime and the controls that can be used to limit the opportunities for fraudsters to commit them. More importantly you will look at how to create the right culture within an organisation to not only discourage collusion in fraud but also to encourage reporting and disclosure. You’ll be able to implement strategies for risk management and responding to financial crime, as well as how to protect your organisation’s IT system.

Contents

Defining financial crime

The role of the accountant

What is financial crime?

The cost of fraud

Management fraud

Identifying criminals to uncover crime

Individuals and financial crimes

Money laundering

Bribery and corruption

FATF and the law

Organisation wide approaches

Corporate culture

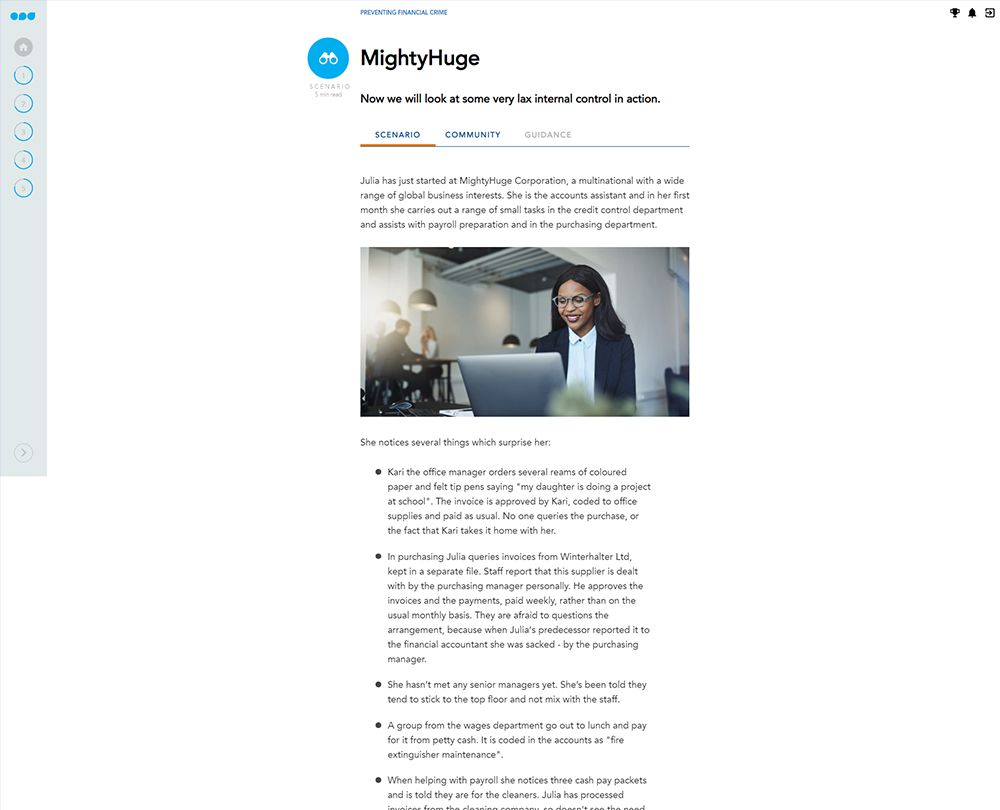

Financial crime within organisations

Safeguarding against misconduct

Policies and procedures

The role of audit

The tone at the top

Individual financial crimes

Criminal motivations

Accounting aspects

Internal controls

The control environment

Monitoring controls

Spotting opportunities

Risk management and control

Inherent risk

Risk management

Risk management approaches

CRSA and ERM

Responding to financial crime

Red flags

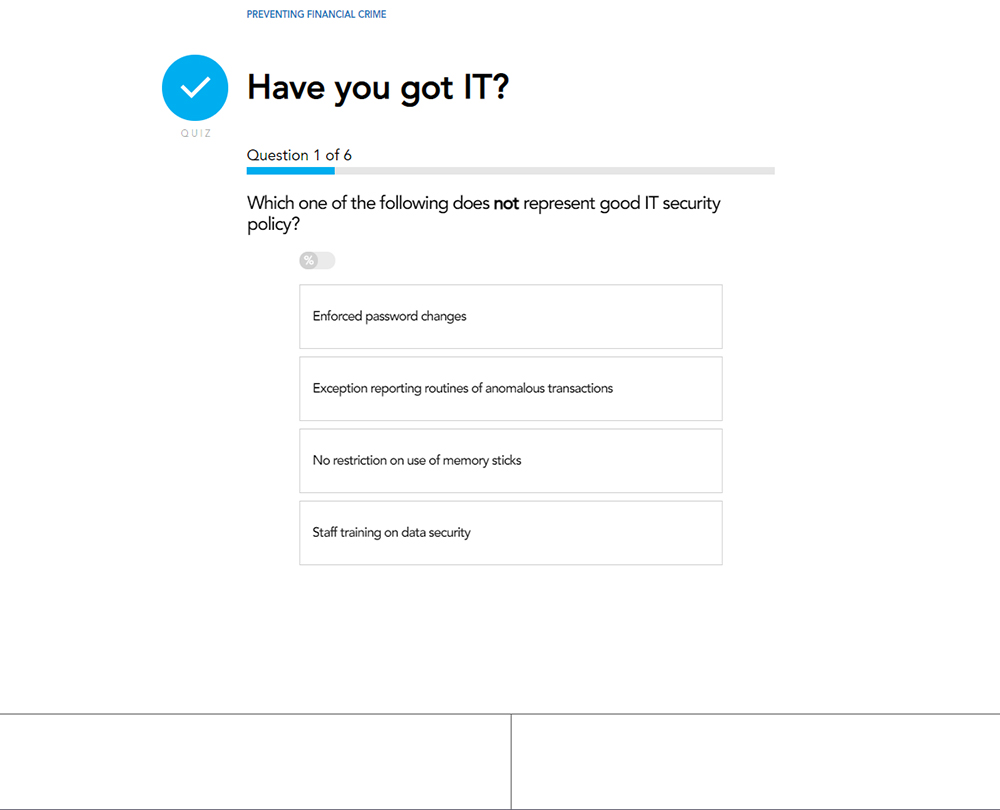

IT approaches to fraud prevention

Assessing IT system risks

Protecting IT systems

The right solutions

Policy and procedure

Areas of vulnerability

Actions to be taken

Cloud computing

Formal risk management

Forensic readiness

How it works

Author

John Taylor

John is a Chartered Accountant who has spent many years advising small and medium-sized businesses across the North of England. John is the author of two industry standard textbooks: Millichamp – Auditing and Forensic Accounting. He has also written several auditing textbooks for AAT courses.

You might also like

Take a look at some of our bestselling courses