Property Taxes

Revised and up to date for 2025/26. Property investment demands careful financial planning, given its high cost. This course equips you to provide expert guidance on UK property taxes, reliefs, and allowances.

£100 +VAT

Property Taxes

£100 +VAT

This course will enable you to

- Get to grips with the key calculations and tax reliefs relevant to property business owners

- Offer sound advice on key tax-free allowances

- Familiarise yourself with the special tax rules and capital gains tax (CGT) reliefs involved with furnished holiday lettings (FHLs)

- Guide your clients on other property taxes issues including recent developments to stamp duty land tax (SDLT)

About the course

Property is always a popular investment, so it’s important that individuals understand the range of taxes involved with such transactions. Business and residential property owners rely on accountants for advice and guidance about the complex UK property tax system.

This course provides an overview of UK property business taxes, the eligibility criteria for tax-free allowances, and the appropriate tax treatment for furnished holiday lettings (FHLs). You’ll also learn about other property tax issues that you need to be familiar with, enabling you to offer your clients the best advice about various property taxes in the UK.

Please Note: This covers only cover UK tax law.

Contents

Overview of property business taxes

Overview

What is a property business?

Property business taxes

Cash basis

Allowable expenses

Tax reliefs

Loss relief

Tax-free allowances

Tax free allowances

Property allowance

Rent a Room relief

Furnished holiday lettings

FHL tax reliefs

Key tax rules

Qualifying conditions

Period of grace election

Capital gains tax reliefs

Other property taxes

The key taxes

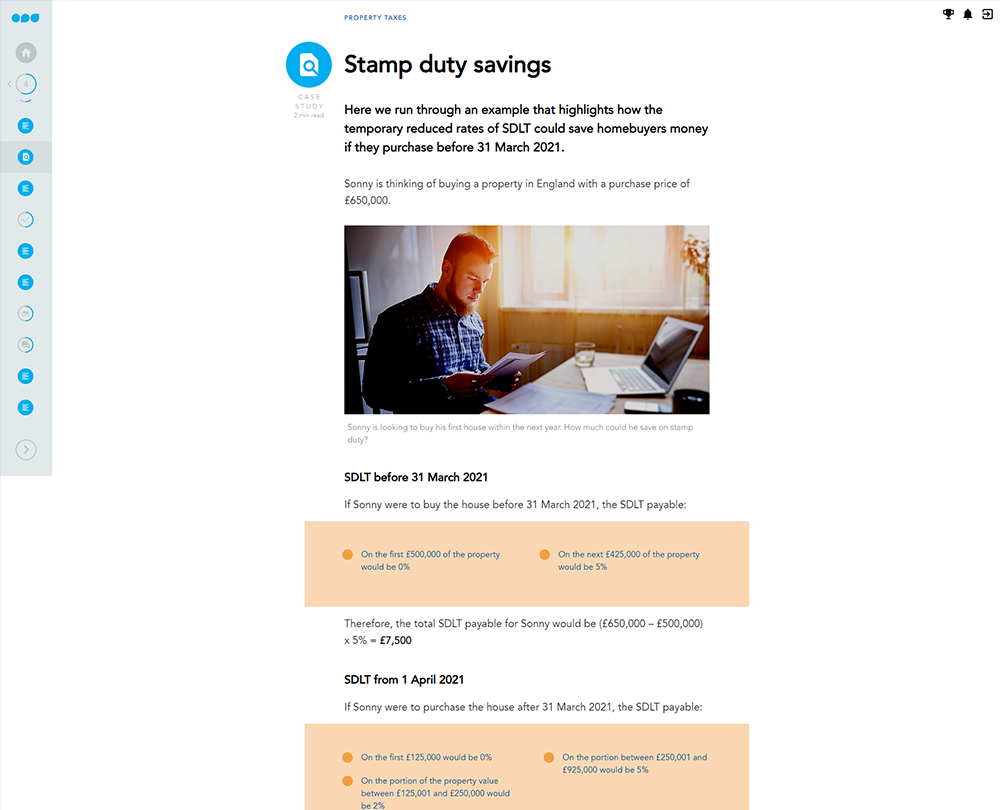

Stamp Duty Land Tax

Land and Buildings Transaction Tax

Land Transaction Tax

Non-resident purchaser’s rates

Non-resident Landlord Scheme

Letting agents and tenants of non-resident landlords

Changes to CGT payment rules

Calculating CGT

How it works

Author

Sarah Laing

Sarah is a Chartered Tax Accountant (CTA) and a member of the Chartered Institute of Taxation (CIOT). Sarah currently works as a freelance tax author providing technical writing services to the tax and accountancy professions.

You might also like

Take a look at some of our bestselling courses