Self-Assessment for Individuals

Revised and up to date for 2025/26. Self-assessment for individuals affects a lot of people, and it is a hugely important area of taxation. This course provides a detailed overview and aims to give you a good understanding of how self-assessment works for individuals.

£100 +VAT

Self-Assessment for Individuals

£100 +VAT

Self-Assessment for Individuals

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Explore the key issues of self-assessment (SA) – focusing on what it is, who it affects, timescales and deadlines, and various statutory record-keeping requirements

- Understand the format of SA returns and various claims and elections that may be required

- Gain knowledge on additional compliance and reporting issues faced by the self-employed

- Register for HMRC’s online services

- Understand HMRC’s enquiries and investigations procedures and learn to negotiate satisfactory outcomes

About the course

Each year, around 12 million individuals in the UK are required to complete a self-assessment tax return. With strict deadlines and significant penalties for non-compliance, mistakes or delays can prove costly. For anyone involved in personal tax, understanding the self-assessment system is essential to avoid risk and ensure obligations are met.

This course outlines the key principles of the UK’s self-assessment regime for individuals. You’ll explore who needs to complete a return, the required timescales, what records must be kept, and how claims and elections are made. The course also covers compliance issues for the self-employed, registering for HMRC’s online services, and handling enquiries or investigations.

By the end of the course, you’ll be equipped with a clear understanding of how the self-assessment system works and the confidence to ensure accurate and timely compliance for yourself, or your clients.

Contents

Key issues of self-assessment

Key issues for individuals

Defining self-assessment

Processing returns

Individuals affected by self-assessment

How self-assessment works

Timescales and deadlines

Record-keeping requirements

Individuals and employees

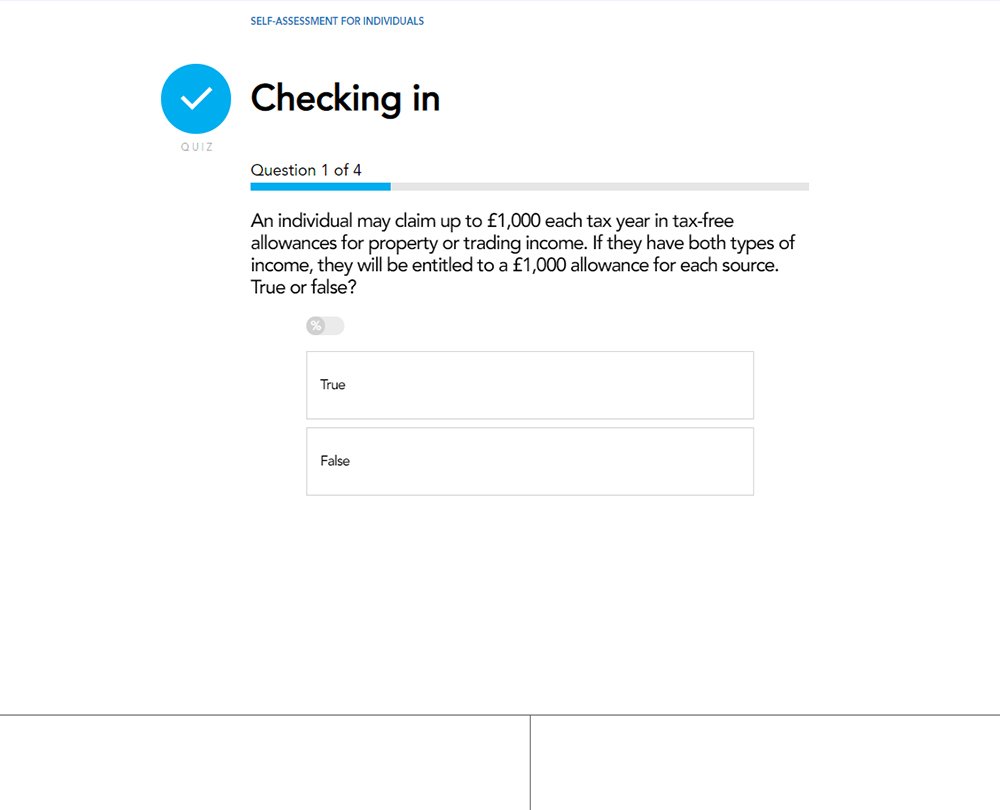

Liabilities and reliefs

Employees and self-assessment

Tax returns and responsibility

Pension contributions

Making claims for gift aid

Marriage allowance claims

Paying tax as an individual

Late payments and penalties

Proposed penalties

The self-employed

Self-employment and self-assessment

Registering for taxable profits

Understanding trading allowance

Choosing the cash basis

Recording payments on account

Other matters affecting self-assessment

Registering online

HMRC oversight

Enquiries and investigations

Closure notices

Making a settlement

Making tax digital

How it works

Author

Sarah Laing

Sarah is a Chartered Tax Accountant (CTA) and a member of the Chartered Institute of Taxation (CIOT). Sarah currently works as a freelance tax author providing technical writing services to the tax and accountancy professions.

You might also like

Take a look at some of our bestselling courses