UK & Ireland GAAP for Small and Micro-Entities

This course looks at the UK GAAP requirements for micro and small reporting entities. You’ll examine the accounting and disclosure requirements and the wider implications and planning aspects, ensuring a smooth transition to a different regime.

£100 +VAT

UK & Ireland GAAP for Small and Micro-Entities

£100 +VAT

UK & Ireland GAAP for Small and Micro-Entities

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Understand the available accounting regimes for small and micro entities and their accounting and disclosure requirements

- Present financial statements in accordance with FRS 105 and FRS 102 Section 1A

- Understand which is the most appropriate accounting regime for your business or clients, and how to adopt it

- Recognise the wider implications and minimise the impact of making the transition to a different regime

About the course

This course looks at the UK GAAP requirements for small and micro reporting entities. These requirements were introduced a while back now in 2016, when significant changes in financial reporting for the smallest companies and other organisations were brought in by the Financial Reporting Council (FRC). The FRC introduced Financial Reporting Standards for the smallest companies, and included a new category of company, the “micro-entity”. A large number of companies in the UK meet the thresholds so these financial reporting standards are relevant and significant to many business owners and their advisors.

This course will help you find out more about the financial reporting options for small and micro-entities. It explores the background to the standards, examines the accounting and disclosure requirements and considers the potential wider implications and planning aspects that should ensure a smooth transition to a different regime.

Contents

The UK and Ireland GAAP regime

Changes in financial reporting

GAAP and IFRS

An overview of UK and Ireland GAAP

Small entities and the accounting regime

What does UK & Ireland GAAP consist of?

The FRS 105 micro-entity regime

The smaller entities regime

FRS 105 – The micro-entity regime

Presenting financial statements in FRS 105

FRS 105 and who can apply for it

Footing the balance sheet

Dealing with accounting treatments

FRS 105 vs FRS 102

Deciding to adopt FRS 105

FRS 102 Section 1A – The small entities regime

Explaining FRS 102 Section 1A

Presenting financial statements

Explaining disclosure requirements

Accounting treatments

Moving from FRS 105 to FRS 102

Additional disclosures

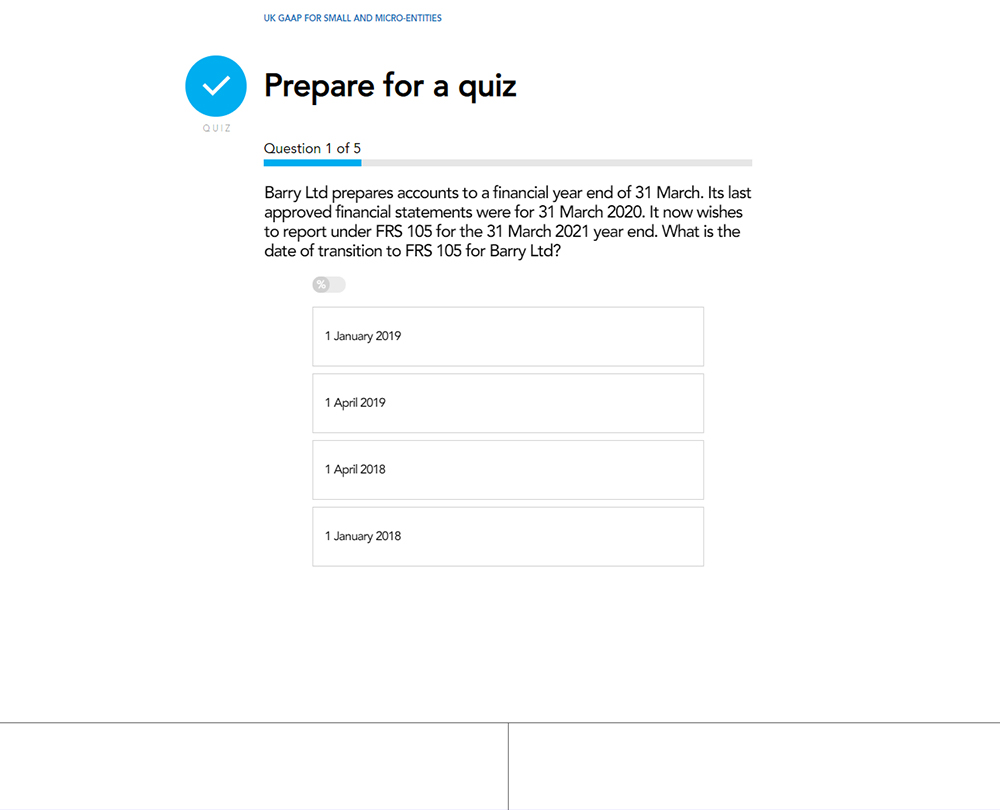

Preparing for transition to a new reporting regime

Accounting for the transition to a new regime

Exemptions from full retrospective application of FRS 102 for small entities

Identifying the main accounting impacts

Considerations when developing new accounting policies

System and control issues to consider

Moving from IFRS to UK GAAP

The wider implications of moving to a new reporting regime

Reasons for transitioning

How it works

Author

Lisa Weaver & Steve Collings

Lisa Weaver is Associate Professor at Warwick Business School, delivering on a range of programmes including MBA. She is a Senior Fellow of the Higher Education Academy in the UK.

Steve Collings is the audit and technical director at Leavitt Walmsley Associates Ltd, Cheshire. He specialises in UK GAAP, IFRS, Solicitors Accounts Rules and auditing and is also a nationwide lecturer on these subjects.

You might also like

Take a look at some of our bestselling courses