VAT for Small Businesses

Revised and up to date for 2025/26. VAT affects many businesses across the globe and getting it wrong can be administratively burdensome and costly. Enhance your knowledge of VAT for small business and discover the governing rules, guidelines and the schemes available to your business or clients.

£100 +VAT

VAT for Small Businesses

£100 +VAT

VAT for Small Businesses

This course is not currently available. To find out more, please get in touch.

This course will enable you to

- Familiarise yourself with the fundamentals of VAT

- Understand how the flat rate scheme can help your business and enable you to calculate the VAT due

- Define the cash accounting scheme, and its advantages and drawbacks

- Understand the annual accounting scheme and how to make advance VAT payments

- Describe the VAT margin schemes available to small businesses

About the course

VAT affects many people and businesses across the globe. Not only are the rules governing it complex, but getting it wrong can be administratively burdensome and, more importantly, costly. However, there are some invaluable VAT schemes that are available to smaller businesses. Understanding who can benefit from these, and what the conditions are, can make a massive difference to your business or clients.

This course will demystify the rules and guidelines that govern VAT that the schemes become easier to navigate. Discover the main features and eligibility of the range of schemes including flat rate, cash accounting, annual accounting and margin.

Please Note: This course only covers UK tax

Contents

VAT: The basics

VAT: An overview

The fundamentals

The accountant’s role in VAT

Registering

Supplies and VAT tax

Compliance

Flat rate scheme

All about the flat rate scheme

The aims of the scheme

Relevant percentage

Eligibility and restrictions

The limited cost trader rate

Leaving the scheme

The cash accounting scheme

All about the cash accounting scheme

The aims of the scheme

Eligibility and restrictions

Advantages and disadvantages

Joining and leaving the scheme

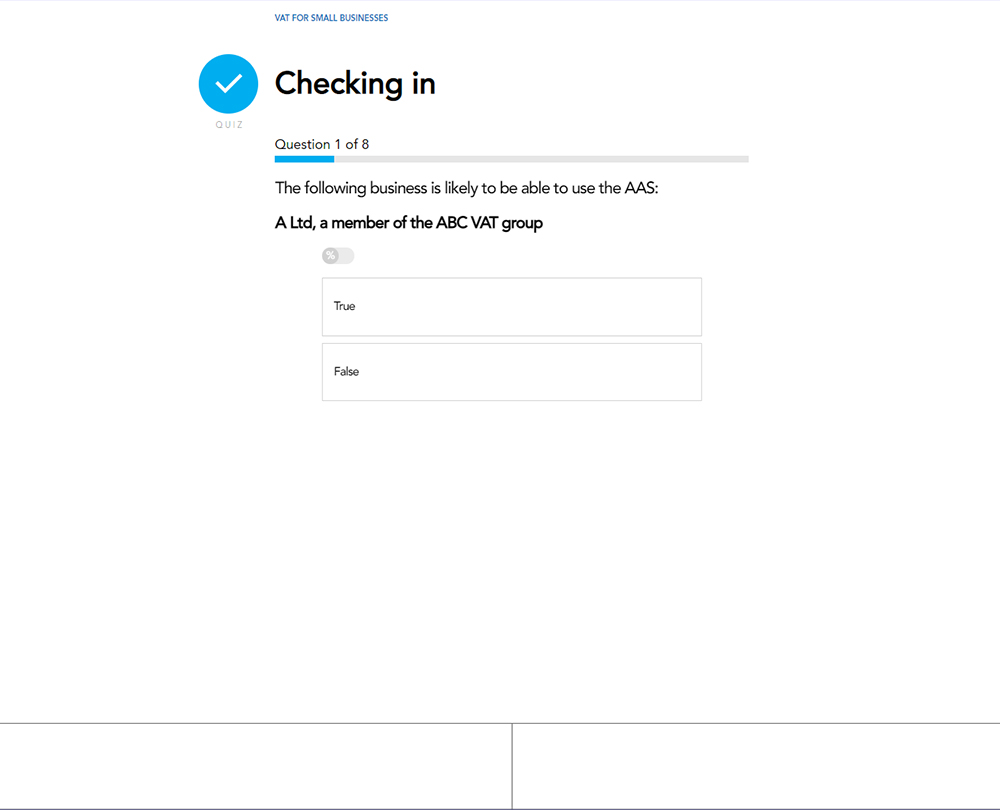

The annual accounting scheme

All about the annual accounting scheme

The aims of the scheme

Advantages and disadvantages

Joining and leaving the scheme

Margin schemes

All about the margin scheme

The aims of the scheme

Eligibility and restrictions

Special rules for car dealers

Joining and leaving the scheme

Global accounting

How it works

Author

Andy Rainford

Andrew Rainford BA (Hons), ATT, CTA trained and qualified with an independent London firm of accountants, and subsequently worked on EY’s personal tax consultancy team.

Now based in North Wales, he runs his own tax consultancy and writing business, Red Dragon Consulting, working directly for private clients and also supporting other tax advisers.

You might also like

Take a look at some of our bestselling courses